Articles de la rubrique "Bookkeeping"

What is the Accounting Equation? Basic & Expanded Formula Explained

Similarly, the business may have unrecorded resources, such as a trade secret or a brand name that allows https://www.instagram.com/bookstime_inc it to earn extraordinary profits. Alternatively, Edelweiss may be facing business risks or pending litigation that could limit its value. Consideration should be given to these important non-financial statement valuation issues if contemplating purchasing an investment in Edelweiss stock. This observation tells us that accounting statements are important in investment and credit decisions, but they are not the sole source of information for making investment and credit decisions.

Equity and the Expanded Accounting Equation

As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved. Moreover, companies may underestimate the cost of long-term debt or overestimate the value of long-term assets.

Example: How to Calculate the Accounting Equation from Transactions

- He forms Speakers, Inc. and contributes $100,000 to the company in exchange for all of its newly issued shares.

- This lack of clarity can make it difficult for auditors or stakeholders to trust the financial data presented to them fully.

- To prepare the balance sheet and other financial statements, you have to first choose an accounting system.

- This equation holds true for all business activities and transactions.

- Liabilities are the claims of creditors (those « outside » the business).

- The dividend could be paid with cash or be a distribution of more company stock to current shareholders.

As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings). Therefore cash (asset) will reduce by $60 to pay the interest (expense) of $60. Required Explain how each of the above transactions impact the accounting equation and illustrate the cumulative effect that they the accounting equation is usually expressed as have.

- Ted is an entrepreneur who wants to start a company selling speakers for car stereo systems.

- They represent the debt and obligations a company owes to external parties.

- As an integral concept in modern accounting, the accounting equation serves as the basis for keeping the books balanced across a specific accounting cycle.

- In this example, we will see how this accounting equation will transform once we consider the effects of transactions from the first month of Laura’s business.

Company worth

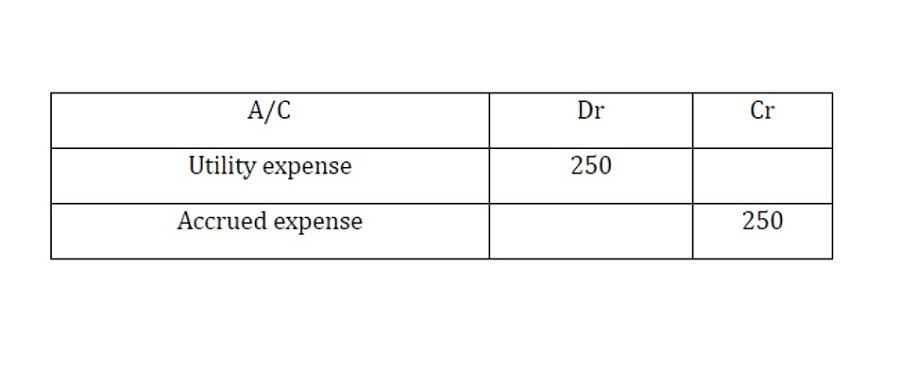

The company owing the product or service creates the liability to the customer. For example, a company uses $400 worth of utilities in May but is not billed for the usage, or asked to pay for the usage, until June. Even though the company does not have to pay the bill until June, the company owed money for the usage that occurred in May. Therefore, the company must record the usage of electricity, as well as the liability to pay the utility bill, in May. Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense.

- Insurance, for example, is usually purchased for more than one month at a time (six months typically).

- It is important to have more detail in this equity category to understand the effect on financial statements from period to period.

- Liabilities are obligations to pay an amount owed to a lender (creditor) based on a past transaction.

- For starters, it doesn’t provide investors or other interested third parties with an analysis of how well the business is operating.

- For instance, underestimating depreciation could make profits look higher than they actually are, which may mislead investors.

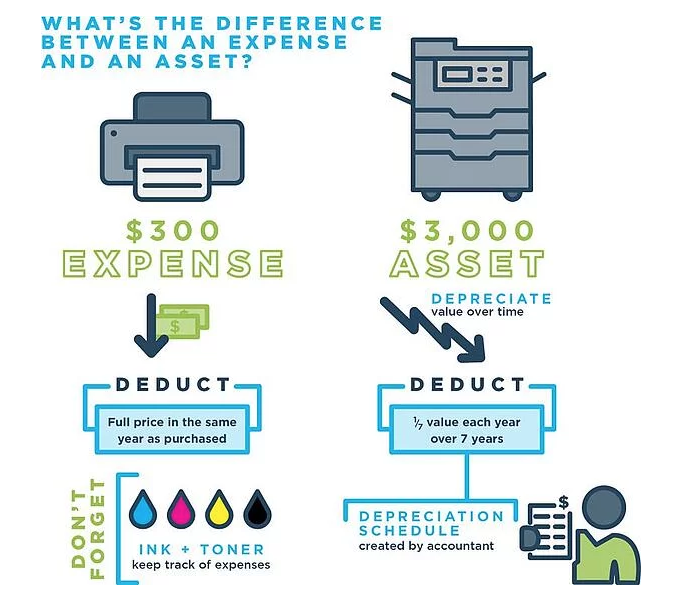

An error in transaction analysis could result in incorrect financial statements. Eventually that debt must be repaid by performing the service, fulfilling the subscription, or providing an asset such as merchandise or cash. Some common examples of liabilities include accounts payable, notes payable, and unearned revenue. The accounts are presented in the chart of accounts in the order in which they appear on the financial statements, beginning with the balance sheet accounts and then the income statement accounts. Additional numbers starting with six and continuing might be used in large merchandising and manufacturing companies. The information in the chart of accounts is the foundation of a well-organized accounting system.

Additional Resources

- The cash (asset) of the business will increase by $5,000 as will the amount representing the investment from Anushka as the owner of the business (capital).

- However, when the owner’s equity is shifted on the left side, the equation takes on a different meaning.

- In every transaction, debit and credit must always balance out to ensure the financial statements accurately reflect the company’s financial position.

- The owner’s investments in the business typically come in the form of common stock and are called contributed capital.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Debits are cash flowing into the business, while credits are cash flowing out.

Although the cash has been reduced, the overall assets remain the same because it has been exchanged for equipment. The total value of the business assets is still $10,000, keeping the equation https://www.bookstime.com/ in balance. Double-entry bookkeeping is a system that records transactions and their effects into journal entries, by debiting one account and crediting another. Creditors include people or entities the business owes money to, such as employees, government agencies, banks, and more.

Catégorie: Bookkeeping | Tags:

QuickBooks Desktop, Compare QuickBooks Desktop to Online

Additionally, the desktop products are only available as annual subscriptions, making them a bigger commitment than QuickBooks Online. With four plans, robust features and a user-friendly interface, QuickBooks Online is the ideal choice for most small businesses. QuickBooks Desktop, on the other hand, is a good option for businesses that prefer desktop software, need its advanced inventory tracking and reporting tools, or are looking for an industry-specific solution. QuickBooks Online is cloud-based with monthly subscriptions, while QuickBooks Desktop is locally installed with one-time purchases. QuickBooks Online offers multi-user access and automatic updates, whereas QuickBooks Desktop allows for advanced customization and industry-specific versions.

Thanks to the cloud, you can also access QBO from the convenience of your smartphone or tablet. This means you can check in and manage your books from anywhere in the world, whether you’re relaxing on a beach in The Bahamas or enjoying a hot chocolate at a ski lodge. If your office computer is a Mac, you can still use QuickBooks Desktop on your Mac.

Best Accounting Software for Small Businesses

Most importantly, Plus will separate the cost of your ending inventory from COGS using first-in, first-out (FIFO). You’ll need to make this tedious calculation in a spreadsheet if you choose a lower-tier plan. Meanwhile, Essentials gives you access to more than 40 reports, including those you can generate in Simple Start. Its additional reports include accounts payable (A/P) and A/R aging, transaction lists by customer, expenses by vendor, uninvoiced charges, unpaid bills, and expenses by supplier summaries. You can drill down to a list of your outstanding invoices instead of only the total outstanding. QuickBooks Online is our overall best small business accounting software.

- This means it’s “harder” to use because QBO is honestly more complicated than QuickBooks Desktop.

- With QuickBooks Online you can easily link to your client’s bank accounts to automate the collection of bank transactions, statements, and receipts.

- However, it doesn’t compare with the more than 500 options offered by QuickBooks Online.

- QuickBooks Online Advanced now offers a fixed asset accounting feature that allows you to enter and track fixed assets, such as vehicles, buildings, and equipment.

- QuickBooks Desktop requires a one-time upfront payment, making it more cost-effective in the long run for users who don’t require regular upgrades.

- This feature is particularly useful if you sell and ship products out of your state.

To help narrow down the best plan for your business, answer a few short questions below. This will offer you a customized recommendation based on the responses you give. Afterward, continue reading our article for a more detailed comparison of the five QuickBooks Online plans. Small to midsize businesses that want a desktop solution or need advanced inventory and industry-specific features.

Optional QuickBooks Online add-ons

What used to be a huge bulk of QuickBooks business is no longer so—it focuses mostly on its cloud version and actively encourages users to make the switch from Desktop to Online. This may signal future abandonment of its Desktop version as more people move to the cloud. If you make the switch from Desktop to Online, you can import your data and access your original company file at any time. QuickBooks Online wins because it offers more professional-looking and customizable invoices than QuickBooks Desktop.

If you’re looking for more from your subscription—like productivity on the go, collaboration with your team, and access on multiple devices (PC, Mac, and mobile)—QuickBooks Online may work better for you. Because QBDT is a local install on your computer, you can access your file at any time. If the internet https://www.quick-bookkeeping.net/ goes out, you’re still able to view, edit, and otherwise work on your books. There’s never any requirement that you have internet connectivity after the initial download and install. When it comes to user limits, the major difference between QBDT and QBO is in how access is granted to additional users.

Receipt management

Subscription clients in QuickBooks Desktop 2023 (R1) or older versions will need to update to the latest 2023 (R3) version before their subscription expires. Similar to other cloud-based apps, QuickBooks Online allows for anytime/anywhere access to your books. The “Plus” subscription affords you certain benefits, including 24/7 support, automatic backups of your QuickBooks file, and yearly https://www.online-accounting.net/ software upgrades. However, in most cases, it’s recommended that you purchase the software-only version. While this means you’d be subject to certain service discontinuations on a rolling three-year basis, you’d be saving money on the annual subscription. Four pricing plans for QuickBooks Online are available, ranging from $30 to $200/month (with an additional $45+/month for payroll).

A notable new feature is Spreadsheet Sync, which helps you generate consolidated reports across multiple entities easily. It is an advanced feature that lets you import and export data between QuickBooks and Microsoft Excel. You can easily generate custom reports in a single spreadsheet, create complex calculations, and use Excel’s built-in tools to work on your data. Once the data is finalized in Excel, you can easily post it back to QuickBooks Online Advanced. Plus allows you to assign classes and locations to your transactions, so you can see how your business performs across divisions, locations, rep areas, or any units that are relevant to your business.

It also has barcode scanning capabilities — business owners can download the QuickBooks Desktop mobile app and use their mobile device as a scanner. QuickBooks Desktop is more traditional accounting software that you download and install on your computer, while QuickBooks Online is cloud-based accounting software you access through the internet. For the Desktop version, you pay an annual fee starting at $549.99 per year, and the cloud-based option starts at $15 per month.

I’ve also had some not-so-great experiences with QuickBooks’ support, but there are occasions when they manage to resolve things well—and that depends greatly on the assigned agent. If you’re a freelancer, stick with its Self-Employed plan, which is $15 per month 9after the three-month discount at $7.50). Features include mileage tracking, basic reporting, income and expense tracking, capture and organize receipts and estimation of quarterly taxes. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. QuickBooks Desktop wins this head-to-head competition, with better reporting, industry-specific features, a better price structure, and more comprehensive features. However, if things like integration and cloud access are important to you, QuickBooks Online may be the way to go.

Each offers a detailed chart of accounts, journal entries, bank reconciliation, accounts payable, accounts receivable, and the basic reports needed to run a company. However, QuickBooks Desktop offers better reporting and supports more complex accounting. QuickBooks Desktop is preferable for companies wanting to manage their books without an internet connection. It’s also the better option for businesses requiring complex inventory accounting features. We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs.

The software offers comprehensive features, unique touches (such as lead management and sales orders), industry-specific versions of the software, and the potential to be more secure. Many satisfied QuickBooks Online users appreciate that they can access the program from any internet-enabled device. Some commented that it’s easy to add vendors and customers and share files with their bookkeepers—and we couldn’t agree more.

The cloud accessibility plus the user-friendly interface makes QuickBooks Online easier to use than QuickBooks Desktop. QuickBooks Online is a cloud-based software that can be accessed anywhere with an internet connection, while QuickBooks Desktop is on-premise—meaning it can only be accessed from the computer where it is installed. QuickBooks Online offers more features on the go and is a better https://www.kelleysbookkeeping.com/ overall value than QuickBooks Desktop. If you don’t need the advanced features offered by the Desktop plan, the Online version will save you money. QuickBooks Desktop is a good choice if you need specialized features such as inventory tracking or forecasting, and you don’t mind paying more for them. Clarify complexity with efficient inventory management and integrated payroll and time tracking.

Catégorie: Bookkeeping | Tags:

Accounting rate of return ARR calculation

Further management uses a guideline such as if the accounting rate of return is more significant than their required quality, then the project might be accepted else not. Evaluating the pros and cons of ARR enables stakeholders to arrive at informed decisions about its acceptability in some investment circumstances and adjust their approach to analysis accordingly. It’s important to understand these differences for the value one is able to leverage out of ARR into financial analysis and decision-making. Very often, ARR is preferred because of its ease of computation and straightforward interpretation, making it a very useful tool for business owners, key stakeholders, finance teams and investors. While it can be used to swiftly determine an investment’s profitability, ARR has certain limitations. If you’re making long-term investments, it’s important that you have a healthy cash flow to deal with any unforeseen events.

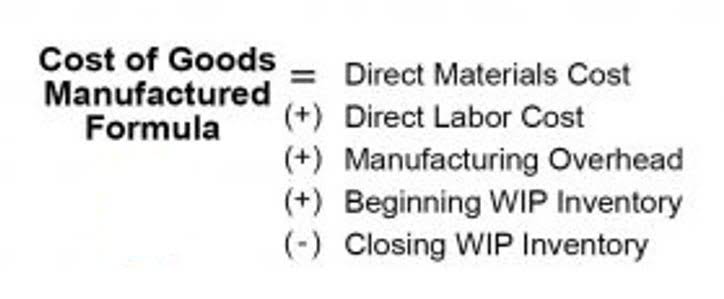

However, it is preferable to evaluate investments based on theoretically superior appraisal methods such as NPV and IRR due to the limitations of ARR discussed below. Here we are not given annual revenue directly either directly yearly expenses and hence we shall calculate them per the below table. We are given annual revenue, which is $900,000, but we need to starting bookkeeping business online work out yearly expenses. As the ARR exceeds the target return on investment, the project should be accepted. The initial cost of the project shall be $100 million comprising $60 million for capital expenditure and $40 million for working capital requirements. For a project to have a good ARR, then it must be greater than or equal to the required rate of return.

Table of Contents

All of our content is based on objective analysis, and the opinions are our own. Some limitations include the Accounting Rate of Returns not taking into account dividends or other sources of finance. For example, you invest 1,000 dollars for a big company and 20 days later you get 300 dollars as revenue. AMC Company has been known for its well-known reputation of earning higher profits, but due to the recent recession, it has been hit, and the gains have started declining.

Get in Touch With a Financial Advisor

This is when it is compared to the initial average capital cost of the investment. Since ARR is based solely on accounting profits, ignoring the time value of money, it may not accurately project a particular investment’s true profitability or actual economic value. In addition, ARR does not account for the cash flow timing, which is a critical component of gauging financial sustainability. Accounting Rate of Return is a metric that estimates the expected rate of return on an asset or investment. Unlike the Internal Rate of Return (IRR) & Net Present Value (NPV), ARR does not consider the concept of time value of money and provides a simple yet meaningful estimate of profitability based on accounting data.

- Further management uses a guideline such as if the accounting rate of return is more significant than their required quality, then the project might be accepted else not.

- Investors and businesses may use multiple financial metrics like ARR and RRR to determine if an investment would be worthwhile based on risk tolerance.

- It should therefore always be used alongside other metrics to get a more rounded and accurate picture.

How do you calculate the Accounting Rate of Return?

It is a very handy decision-making tool due to the fact that it is so easy to use for financial planning. The ARR formula calculates the return or ratio that may be anticipated during the lifespan of a project or asset by dividing the asset’s average income by the company’s initial expenditure. The present value of money and cash flows, which are often crucial components of sustaining a firm, are not taken into account by ARR. The Accounting Rate of Return formula is straight-forward, making it easily accessible for all finance professionals. It is computed simply by dividing the average annual profit gained from an investment by the initial cost of the investment and expressing the result in percentage.

Find out how GoCardless can help you with ad hoc payments or recurring payments. ARR illustrates the impact of a proposed investment on the accounting profitability which is the primary means through which stakeholders assess the performance of an enterprise. One of the easiest ways to figure out profitability is by using the accounting rate of return.

Another variation of ARR formula uses initial investment instead of average investment. The accounting rate of return is a capital budgeting indicator that may be used to swiftly and easily determine the profitability of a project. Businesses generally utilize ARR to compare several projects and ascertain the expected rate of return for each one.

In today’s fast-paced corporate world, using technology to expedite financial procedures and make better decisions is critical. HighRadius provides cutting-edge solutions that enable finance professionals to enrolled agent salary streamline corporate operations, reduce risks, and generate long-term growth. The Record-to-Report R2R solution not only provides enterprises with a sophisticated, AI-powered platform that improves efficiency and accuracy, but it also radically alters how they approach and execute their accounting operations. If you’re making a long-term investment in an asset or project, it’s important to keep a close eye on your plans and budgets.

Catégorie: Bookkeeping | Tags:

What is a Ledger in Accounting? Is There a Difference with a Journal and a Ledger?

By the end of the exercise, there will be over ten transactions in this ledger alone. To record this in the ledger, it is as simple as putting $10,000 in the credit column. In the Details column, we’ll write “Bank”, as this allows us to see what the other side of the transaction was. The ledger uses the T-account format, where the date, particulars, and amount are recorded for both debits and credits.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Sign up to a free course to learn the fundamental concepts of accounting and financial management so that you feel more confident in running your business. Suppose you discover after reconciliation that certain amounts were not correctly recorded in your Ledger. It could be an entry with an incorrect amount or an entry you completely omitted to record in your General Ledger Accounts. Under this step, you need to check the amounts recorded in each transaction forming part of your General Ledger.

Therefore, you need to prepare various sub-ledgers providing the requisite details to prepare a single ledger termed as General Ledger. Thus, General Ledger contains individual accounts in which similar transactions are recorded. These transactions relate to an asset, a liability, an individual, or an mark to market accounting expense. Let’s take an example to understand how you can transfer the journal entries to General Ledger. Now, each of your transactions follows a procedure before they are represented in the final books of accounts. First, the transactions are recorded in the Original Book of Entry, known as Journal.

- In financial accounting, a company’s main accounting record is its general ledger.

- Thus, as per the above table, the credit sales figure of $200,000 would go into the accounts receivable control account.

- This means you first need to record a business transaction in your Journal.

- Financial statements like the income statement, balance sheet, and cash flow statement show the financial health of a business.

- Because our journal consists of entries to the Bank and Loan accounts, we’ll need the Bank and Loan ledgers.

This helps accountants, company management, analysts, investors, and other stakeholders assess the company’s performance on an ongoing basis. In the double-entry system, each financial transaction affects at least 2 different ledger accounts. Each entry is recorded in two columns, with debit postings on the left and credit entries on the right of the ledger. To gather journal information, users must understand debits and credits.

How to Write a Business Proposal [Examples + Template]

Because a cash book is updated and referenced frequently, similar to a journal, mistakes can be found and corrected day-to-day instead of at the end of the month. A sales ledger is a detailed list in chronological order of all sales made. This ledger is often also used to keep track of items that reduce the number of total sales, such as returns and outstanding amounts still owed. For more small business budgeting and balance sheet resources, see our list of downloadable small business balance sheet templates.

Accounting ledgers are an essential aspect of small business bookkeeping. As a small business owner, you need to be aware of all the transactions your business has completed in an accounting period. In it, you will obtain transaction-related data that include cash, receivables, inventory, debt, and expenses.

Ledgers allow the company to quickly view all transactions in an account at once. Fortunately, keeping a ledger is fairly simple, requiring you to log every financial transaction from your business in a journal and the general ledger. It includes the transaction date, particulars of the transaction, folio https://www.wave-accounting.net/ number, debit amount, and credit amount. A ledger account is a record of all transactions affecting a particular account within the general ledger. The ClickUp Summary of Financial Accounts Template is designed to keep everything you need to know about your general ledger accounts on one convenient list.

QuickBooks Online users have access to QuickBooks Live Assisted Bookkeeping, where experts provide guidance, answer questions, and show you how to do tasks in QuickBooks. Have more time to work on what you love when you spend less time on bookkeeping. In addition to the accounting ledger, there are several kinds of ledgers that you might use in the course of bookkeeping for your business. Most accounting software will compile some of these ledgers while still letting you view them independently.

A General Ledger is one of the important records in the system of accounting. It is prepared after you pass journal entries in the Books of Original Entry (Journal). Sales Ledger or Debtors Ledger is one of the three types of Ledgers that you prepare as a firm or a business entity. It records all the transactions that take place between you and your debtors. Here, debtors are nothing but the business entities to whom you have sold goods that you manufacture.

Further, it provides detailed information with regards to such accounts. Then, the balance of each of the General Ledger Accounts is posted in your Trial Balance Sheet. Once you complete the Trial Balance, the account balance is finally entered in the income statement and the balance sheet. Basically, a ledger is where all journal entries are being summed up with the specific account names drawn from the chart of accounts used as a heading. The income statement follows its own formula, which works as follows.

We and our partners process data to provide:

A general ledger template is a premade framework that provides a standardized format for recording and organizing these financial transactions. This software ensures the general ledger will sort all transactions through the proper accounts to create accurate financial records. With QuickBooks for Small Businesses you can connect all of your business accounts seamlessly and track all expenses in one place. Where once all journal entries and general ledger accounts were manually recorded by hand, now technology can automate the accounting process.

What Makes a Good General Ledger Template?

However, they can provide users with more insight into their financial transactions which may give them the ability to make better decisions as managers or owners of a business. This will be helpful when it comes time to prepare reports such as cash flow statements and balance sheets which require users to provide information on their expenses. The accounting ledger provides users with the ability to keep tabs on their finances. It is broken down into several different accounts that show what assets are, liabilities and equity, revenues/income, and expenses/costs. But you don’t have to be intimately acquainted with journals and ledgers to keep tabs on the financial health of your business. Using the best accounting software or working with a professional bookkeeper or accountant makes it easier to record every transaction and make sure they balance every time.

Every business must strive to maintain accurate accounting records to generate reliable financial statements. A journal entry includes an account number, a date, a dollar amount, and a description of the entry. In some cases, accountants post information to control accounts and then transfer the data into a journal entry. As previously noted, each account has a basic characteristic regarding the double-entry namely debit and credit records. Cash accounts are one part of an asset account that has normal properties or balance in the debt position.

A general ledger account that holds all subsidiary ledger accounts is known as a control account. In making examples of ledger format in accounting, and before recording a general journal. In the ledger, each active account is neatly organized in the CoA list. The number on the accounts is sequential according to the type of account itself.

General ledger templates quickly create a foundation for accurate and comprehensive accounting records, often combining this function with other tools to make your job easier. All this allows for efficient, consistent bookkeeping practices with less tedium. To get the most out of your general ledger (and all other reports), set up the company’s structure properly. Hire an accountant or bookkeeper, or learn how to set up the chart of accounts and classifications for your company’s accounting system.

Accordingly, all the cash or credit purchase transactions entered into with William Paper Mill would be recorded under the account of William Paper Mill. Liabilities are current or future financial debts the business has to pay. Current liabilities can include things like employee salaries and taxes, and future liabilities can include things like bank loans or lines of credit, and mortgages or leases. A cash book functions as both a journal and a ledger because it contains both credits and debits.

Furthermore, General Ledger Accounting also helps you to spot material misstatements with regard to various accounts. Also, the accounting professional auditing your company accounts may ask for sales receipts, purchase invoices, etc. This is because General Ledger Accounts records transactions under various account heads.

Catégorie: Bookkeeping | Tags:

Statement Of Retained Earnings What Is It, How To Prepare?

But retained earnings provides a longer view of how your business has earned, saved, and invested since day one. Retained earnings provide a much clearer picture of your business’ financial health than net income can. If a potential investor is looking at your books, they’re most likely interested in your retained earnings. Retained earnings are like a running tally of how much profit your company has managed to hold onto since it was founded. They go up whenever your company earns a profit, and down every time you withdraw some of those profits in the form of dividend payouts.

Beginning retained earnings and negative retained earnings

One of them is the income statement, and you’ll need to process expenses to put this statement together. If a company has a net loss for the accounting period, a company’s http://svadba.pro/mashafeeg shows a negative balance or deficit. You can find the beginning retained earnings on your balance sheet for the prior period.

What Is Statement of Retained Earnings?

Retained earnings are profits a company keeps instead of paying to shareholders as dividends, crucial for growth. For example, any common stock you buy back during the year should be deducted from the earnings. Similarly, if you’ve decided to pay dividends, subtract dividends from the https://ejg.info/en/available-information.html retained earnings. The statement of retained earnings—what we’re focusing on today—tells you how much of the current year’s earnings were distributed as dividends and reinvested into the business. Also, it can be used by investors to compare companies in similar kinds of business.

Why are retained earnings important for small business owners?

On the other hand, though stock dividends do not lead to a cash outflow, the stock payment transfers part of the retained earnings to common stock. For instance, if a company pays one share as a dividend for each share held by the investors, the price per share will reduce to half because the number of shares will essentially double. Because the company has not created any real value simply by announcing a stock http://newspmr.com/novosti-pmr/politika/2976 dividend, the per-share market price is adjusted according to the proportion of the stock dividend. A statement of retained earnings shows changes in retained earnings over time, typically one year. Retained earnings are profits not paid out to shareholders as dividends; that is, they are the profits the company has retained. Retained earnings increase when profits increase; they fall when profits fall.

What is a statement of retained earnings?

In the final step of building the roll-forward schedule, the issuance of dividends to equity shareholders is subtracted to arrive at the current period’s retained earnings balance (i.e., the end of the period). From a more cynical view, even positive growth in a company’s retained earnings balance could be interpreted as the management team struggling to find profitable investments and opportunities worth pursuing. Although this statement is not included in the four main general-purpose financial statements, it is considered important to outside users for evaluating changes in the RE account.

Generally, companies like to have positive net income and positive retained earnings, but this isn’t a hard-and-fast rule. The decision to pay dividends or retain earnings for future capital expenditures depends on many factors. Net income is the company’s profit for an accounting period, calculated by subtracting operating expenses from sales revenue. To calculate retained earnings to market value, divide the share price by the retained earnings per share. For example, suppose your company’s share price increased from $10 to $60 over the past five years and the total earnings retained per share over the same five years is $5. The statement of retained earnings is a financial document that summarizes how the company’s retained earnings—aka the revenue they’ve kept after paying for expenses—changed during a given period.

Do you own a business?

- For example, even if you retain earnings to invest in a major marketing campaign, you need enough cash on hand to execute your plan.

- Retained earnings does not reflect cash flow, but rather the money left over after financial obligations have been paid.

- Being better informed about the market and the company’s business, the management may have a high-growth project in view, which they may perceive as a candidate for generating substantial returns in the future.

- Below is the balance sheet for Bank of America Corporation (BAC) for the fiscal year ending in 2020.

- If your business is seasonal, like lawn care or snow removal, your retained earnings may fluctuate substantially from one quarter to the next.

- These include revenues, cost of goods sold, operating expenses, and depreciation.

It’s the amount your company is left with after subtracting all expenses, including operating and non-operating expenses, one-off expenses, and taxes. Up-to-date financial reporting helps you keep an eye on your business’s financial health so you can identify cash flow issues before they become a problem. Not sure if you’ve been calculating your retained earnings correctly? We’ll pair you with a bookkeeper to calculate your retained earnings for you so you’ll always be able to see where you’re at. A statement of retained earnings should have a three-line header to identify it. But while the first scenario is a cause for concern, a negative balance could also result from an aggressive dividend payout, such as a dividend recapitalization in a leveraged buyout (LBO).

Significance of retained earnings in attracting venture capital

It can go by other names, such as earned surplus, but whatever you call it, understanding retained earnings is crucial to running a successful business. If your business recorded a net profit of, say, $50,000 for 2021, add it to your beginning retained earnings. Looking for more business-centric financial resources just like this? The examples in this article should help you better understand how retained earnings works and what factors can influence it. Keep researching to deepen your understanding of retained earnings and position yourself for long-term success.

- Retained earnings are reported in the shareholders’ equity section of a balance sheet.

- Since they represent a company’s remainder of earnings not paid out in dividends, they are often referred to as retained surplus.

- As the formula suggests, retained earnings are dependent on the corresponding figure of the previous term.

- These adjustments could be caused by improper accounting methods used, poor estimates, or even fraud.

- This can make a business more appealing to investors who are seeking long-term value and a return on their investment.

Additional Paid-In Capital

To find your shareholders’ equity (or owner’s equity) balance, subtract the total amount of dividends paid out from the beginning equity balance. Thus, you’ll have a crystal-clear picture of how much money your company has kept within that specific period. A statement of retained earnings is a financial statement that shows the changes in a company’s retained earnings balance over a specific accounting period.

Catégorie: Bookkeeping | Tags:

How to Use the QuickBooks Online Undeposited Funds Account

It will take you to the bank deposit screen where you can uncheck the checkbox for the payment you wish to remove, and then click Save and close. The payment will automatically go back to the Undeposited Funds account. Next, select the account to which the funds will be deposited and add the payments to the deposit. Make sure to verify the details and allocate the funds to the appropriate income or expense accounts. Take your time to verify the details before finalizing the clearing of undeposited funds to maintain the integrity of your accounting records.

Use the Receive payment form when your customer pays you for an invoice and the Sales receipt form when you receive immediate payments. The importance of this step becomes even more apparent in the next screenshot. As we know, reconciling is an integral part of your books and keeping them accurate. When it comes time to reconcile an account, you have your bank statement in one hand and QuickBooks Online in another.

Perhaps you forgot to record a prior deposit or the check was lost and never deposited. You’ll also notice that when you click on the deposit, it expands and you can choose to edit. This is the convenience of this special account I know you’ll learn to love. Learn how to put payments into the Undeposited Funds account in QuickBooks Desktop. Maintaining good record-keeping practices and conducting regular audits can help in preventing and addressing duplicate transactions effectively.

- This is the convenience of this special account I know you’ll learn to love.

- These funds serve as a temporary holding account and allow for grouping multiple payments together before depositing them into the designated bank account.

- Cleaning up undeposited funds in QuickBooks Online is essential to ensure accurate accounting records and maintain financial transparency.

- Before initiating the clearing process, it is crucial to review the undeposited funds account in QuickBooks Online to identify all pending payments and receipts awaiting deposit.

Including Additional Checks Into Your Deposit

Here’s how to put payments into your Undeposited Funds account. If a customer paid with a check or their payment comes with a reference number, you can record that information in QuickBooks as well. If you see a balance in Undeposited Funds on your balance sheet, you need to investigate. Again, make sure you are selecting Undeposited Funds from the “Deposit To” drop-down menu, and save the transaction.

Step 3: Match Deposits to Invoices and Payments

Choose your customer from the drop-down menu and their open invoice will automatically show up on the list. This process involves identifying the undeposited funds, verifying the reasons for their deletion, and making corresponding adjustments in the account. It is insurance expense definition crucial to maintain a clear trail of documentation to support the deletion, such as notes detailing the reason for the adjustment and any approvals required.

Reconcile Your Accounts

It’s possible the deposit was posted straight to an Income account rather than matched to payments received. Also check for two separate deposits for $1,675.52 and $387, respectively. If you added a payment to a deposit by mistake, you can remove that payment easily by clicking on the deposit or amount field in the deposit entry line in the Deposit Detail report.

It helps to reconcile any inconsistencies and prevent errors in financial reporting. Cleaning up undeposited funds in QuickBooks Online is essential to ensure accurate accounting records and maintain financial transparency. By following the step-by-step methods outlined in this article, you’ll gain a clear understanding of how to manage undeposited funds effectively, ensuring the accuracy of your financial data.

What is the Undeposited Funds Account in QuickBooks?

Well, get ready to learn something new and take a thorough look at Undeposited Funds. Learn how to use the Undeposited Funds account in QuickBooks Desktop. Learn how to use the Undeposited Funds account in QuickBooks Online. You don’t need to do this if you’re free bookkeeper certification practice exams downloading transactions directly from your bank.

For this, we have a detailed guide on how to set up the products and service list in QuickBooks Online. From the Sales receipt form, you’ll need to provide the requested details. Suppose we recently received an upfront payment of $150 in cash from Robert Allard for an A/C repair service. When you immediately receive a cash or a check for a sales transaction without having created an invoice, then you must use the Sales types and properties of assets receipt form to record the check and revenue. Accurate record-keeping is essential to ensure that the deletions are properly accounted for in financial reports and compliant with regulatory requirements.

Catégorie: Bookkeeping | Tags:

What Is Project Accounting? Principles, Methods & More

Documentation is required to record the project costs that are incurred throughout the project. Under ASC 605, companies could use the completed contract method, recognizing revenue only when https://pmrgid.com/video/displayresults/0?pattern=finance&rpp=0&sort=0&ep=&ex= a project was fully complete. This was intended to be utilized when reliable estimates could not be made, on very short jobs, or when there was a risk the project wouldn’t be completed.

- It is a crucial yet complex part of financial reporting in the construction and industrial sectors, in which projects often extend over long periods.

- Moreover, in case you spot any potential problems with your project, it’s crucial to take action right away.

- According to Project Accounting Australia, project accounting is “a specialized form of accounting that focuses primarily on project delivery”.

- In diligence, by looking back at the specific costs, it can be determined exactly how conservative each month was, and revenues can be adjusted to the periods they relate.

- Having a single source of truth for all project financials saves time for many critical tasks, like data management and strategic advising.

- On the other side, clients would either have their own fixed budget or ask you to give a rough estimate of how much a project is going to cost.

Essential Financial Management Techniques

It’s an active form of project management that allows key decision makers to identify the reasonable benefit of a project and monitor the costs of delivering it in real time. Project cost or project budget is where https://www.zelezo.net.ua/news.php?readmore=1578 fits in, with a focus on the financial management processes. What’s more, project accounting is extremely valuable when it comes to estimating expenses for future projects.

Financial Accounting and Auditing

The cost-to-cost method may be used to calculate the revenue for each period the project is broken down into, which could be weeks, months, or years. Scope creep is what you call a project correctional https://wikigrib.ru/raspoznavaniye-gribov-89537/ phase, a stage common with poorly planned projects with the sole aim of bringing the project back on track. This is the stage where you create or make all the plans and allocations for the project.

Step 5: Set up real-time expense and time-tracking

With project forecasting, construction companies were better prepared to adjust their budgets accordingly. Your choice of method depends on your business and accounting standards, such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). While Productive offers insights into both invoiced and recognized revenue, its main benefit is in enabling you to track and forecast your revenue through the Resource Planning feature. This can be done with cash or credit on the delivery of goods or services. This is commonplace in retail stores but can also apply to project deliverables. If you are unsure if your current computer or internet access allows you to complete your online learning with us, please contact us before applying to enrol.

- The financial performance of a project is not just about the revenue numbers.

- Wendy is a Chartered Professional Accountant (CPA) and Certified Management Accountant (CMA) with over 10 years of experience as a finance and accounting leader.

- Take your project and resource management to the next level with our AI-driven platform.

- Since $500 of revenues were recognized through period four, an incremental $200 was recognized in period five.

- Project-based accounting helps track every dollar spent on the office complex.

The Beginner’s Guide to Project Accounting

Where executed correctly, project accounting undoubtedly improves the financial performance of every single project you take on. Project accounting and financial accounting are two different types of accounting methods that follow the same accounting fundamentals. Typically, project accounting is used by Professional Services Organizations (PSOs) or consulting firms that use an accrual-based accounting method. This typically means these organizations are over $5M in annual revenue (otherwise organizations may use the cash-based accounting method).

Tip #1: Set the budget for the project

They also prepare financial reports specific to each project, which lets managers make data-driven decisions that drive project success. The benefits of project accounting are clear, but many cannot be achieved without the proper tools. ProjectManager is work and project management software that captures real-time data for more insightful decision-making. Organize costs and resources and monitor them in real time to better manage your budget and deliver success to your stakeholders. Without having your team register time every day, you’ll have no idea if the project is making headway and won’t be able to calculate real-time cost.

Project Accounting Software: Types and Key Features

Some courses require you to have studied at a particular level prior to enrolling. Whether courses are delivered online, on paper or a mixture of both, there may also be components such as workshops, noho marae, work experience and practicum to participate in. By following these steps and exploring the plethora of provided topics, you can transform your academic experience into a fulfilling and insightful exploration of the accounting world.

Catégorie: Bookkeeping | Tags:

What the Percent of Sales Method Is and How To Use It

Learn how to use the sales revenue formula so you can gauge your company’s continued viability and forecast more accurately. With a revenue of $60,000, she’s not running a corporation, but she should still expect to run into a small amount of bad debt expense. By looking over her records, she finds that for the month, her credit purchases come to $55,000 (with $5,000 cash). Liz’s final step is to use the percentages she calculated in step 3 to look at the balance forecasts under an assumption of $66,000 in sales. Next, Liz needs to calculate the percentage of each account in reference to her revenue by dividing by the total sales. Most businesses think they have a good sense of whether sales are up or down, but how are they gauging accuracy?

How much are you saving for retirement each month?

- Any fixed expenses — like fixed assets and debt — can’t be projected with the percent of sales method.

- Quickly surface insights, drive strategic decisions, and help the business stay on track.

- Those percentages are then applied to future sales estimates to project each line item’s future value.

- But you’re not done yet because you can have it apply the changes to the entire column when you update numbers.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- We’ll use her business as a reference point for applying the percent of sales method.

To determine her forecasted sales, she would use the following equation. The Percentage of Net Sales Method works by assigning a cost to each item in the ending inventory equal to the percentage of net sales realized from that item during the period. When an item is sold, it is given a cost equal to its assigned percentage multiplied by the total net sales for that period. Just like weather forecasters sometimes get it wrong, the percentage of sales method also has limitations. Determine the balances of the line items and calculate their percentages relative to your sales. It lets you look at past sales to make smart predictions for the future.

- Here are some of the reasons the percentage-of-sales method might not be for you.

- By looking over her records, she finds that for the month, her credit purchases come to $55,000 (with $5,000 cash).

- This helps businesses get a sense of their short-term financial outlook.

- Frank had a holiday hit selling disco ball planters online and he wants to know what his expenses and assets will look like if sales keep going up.

How to Use Regression Analysis to Forecast Sales: A Step-by-Step Guide

- But, using it along with other techniques can provide an even clearer picture of your business’s financial health.

- Plus, you’ll get some tips for good practices for your business.

- Especially when it comes to creating a budgeted set of financial statements.

- There are five basic steps to the percentage of sales method formula.

- The balance in this account will always be a function of a predetermined percentage of credit sales when the net-sales method is used.

- Then, they can utilize their accounting documents to find the figures.

- This data encompasses sales and all business expenses related to sales, including inventory and cost of goods.

He would then apply those percentages to $400,000, rather than the $250,000 from this year. Here are some of the https://www.bookstime.com/articles/financial-statements-for-banks reasons the percentage-of-sales method might not be for you. The best part of this method is it doesn’t need loads of data to work, just the prior sales and a calculator (or software, if you want to make life easier). It’s also useful for risk management as it helps anticipate any financial challenges on the horizon, giving companies enough time to change course or correct any errors. That’s what we’ll cover in this guide to the percentage-of-sales method.

Easy to compare across businesses

The percentage-of-sales method is used to develop a budgeted set of financial statements. Each historical expense is converted into a percentage of net sales, and these percentages are then applied to the forecasted sales level in the budget period. For example, if the historical cost of goods sold as a percentage of sales has been 42%, then the same percentage is applied to the forecasted sales level. The approach can also be used to forecast some balance sheet items, such as accounts receivable, accounts payable, and inventory. The percentage-of-sales method is a financial forecasting model that assesses a company’s financial future by making financial forecasts based on monthly sales revenue and current sales data. The percentage of sales method definition refers to businesses’ forecasting tools to predict multiple liabilities, expenses, and assets based on their sales data.

There are several advantages to using the percentage-of-sales method. First, it is a quick and easy way to develop a forecast within a short period of time. And second, it can yield high-quality forecasts for those items that closely correlate with sales. The percentage of receivables method is similar to the percentage of credit sales method, except that it looks at percentages over smaller time frames rather than a flat rate of BDE.

Because the percentage-of-sales method works closely with data from sales items, it’s not the best forecasting method for things like fixed assets or expenses. When you can quickly create sales forecasts, you can adapt to sudden storms. Leverage the percentage of sales method to get a clear vision of your percentage of sales method formula financial future so you can map strategies that work.

Mastering Sales Percentages for Success

It is also important to establish controls and procedures to prevent the manipulation of https://www.instagram.com/bookstime_inc sales figures. Additionally, it is recommended that companies periodically review their inventory costing methods to ensure that the Percentage of Net Sales Method continues to be the most appropriate for their needs. Based on this data, the debit to the uncollectible accounts expense is 2% of net credit sales of $1 million, or $20,000.

Catégorie: Bookkeeping | Tags:

What Is Ecommerce? The Complete Guide To Online Selling 2024

You’ll have to pay for the other great guys that you might prefer. If you’re into spending more for the best, you can reach out to an expert to customize a theme for you or design one from scratch.. BigCommerce falls short here with only a fraction of the app store offerings as its competitors. If you need an app that isn’t already built for Bigcommerce, you’re out of luck idle time vs overtime in cost accounting or will have to hire someone to build it for you.

Built-in security measures and automatic updates ensure your online store is always running on the latest software, including security updates. The right ecommerce platform will also offer features to help you manage your business and finances. This includes sales reporting and analytics, sales tax calculation, and integration with accounting software. AI is transforming how ecommerce platforms operate, making them smarter and more responsive to both merchant and customer needs.

- Pricing for Adobe Commerce is quote-based, which means you’ll need to talk to a customer support representative about your needs before getting an estimate.

- The best platforms have app stores with hundreds of options to choose from.

- Its website contained thousands of products and tons of integrations, making content management exhausting.

- You’ll learn which platform meets your needs, performs the best, and gives you value to dominate your niche.

- Tiered pricing starts at 2.59% plus 49 cents per transaction using Braintree; otherwise, whatever fees your chosen payment processor charges.

Find the right ecommerce platform for your business model

However, you might not need those extensions, and there are good free themes. You’ll still need to invest in WooCommerce hosting, so factor this into your budget. Shift4Shop doesn’t do as well as BigCommerce and Shopify despite being older than they are and the reason is clear. Although there is a nice onboarding video when you log into your inventory turnover ratio analysis dashboard, the whole operation is hard to figure out; the builder is not very visually appealing.

Ecommerce, short for electronic commerce, refers to the buying and selling of goods and services over the internet. It involves a transaction between two parties, usually a business and a consumer, where the payment and delivery of products or services are conducted online. In order to be competitive, ecommerce brands need to have robust return policies and customer service systems in place to handle customer inquiries and complaints. This can be challenging, especially for businesses that sell complex or technical products, or for small businesses with little or no staff. An ecommerce platform is a service that allows you to make money online through your own website.

You’re our first priority.Every time.

You can also add services like local delivery and take advantage of the Shopify Fulfillment Network. Similarly, understanding whether your business primarily serves consumers (B2C) or other businesses (B2B) can significantly influence your choice of an ecommerce platform. SEO tools, email marketing tools, social media integration, and customer review functionality will help you develop an ongoing marketing strategy. Shop Pay, for instance, increases checkout speed by four times. Shopify also offers simple integrations with more than 100 payment gateways, so you can offer the most relevant payment options for your audience, no matter where they are in the world. Volusion makes it easy to integrate with over 30 payment gateways and provides essential tools for creating an online store without unnecessary complications.

Compare the best ecommerce website builders to find one that fits your needs. If you want to sell products online, you’ll find the right platform on this page. Self-hosted or non-hosted ecommerce platforms require merchants to use their own server space or pay to rent space from a hosting provider.

Most users have reported it slowing down as they get more products and customers. The templates they have are more industrial, but they feel outdated. Also, customizing the store takes adjusted gross income a lot of time to understand and get used to except for experienced users because there’s no drag-and-drop functionality.

Save on Storefront Costs

The best platforms have app stores with hundreds of options to choose from. All plans include a custom domain (free for one year), customer accounts, unlimited products, abandoned cart recovery, the ability to sell on social channels, and ad vouchers. Using these, you can connect your store with print-on-demand providers, dropshipping suppliers, fulfillment centers, and more. You can use apps to manage products and inventory, streamline your operations, generate more traffic, optimize your conversion rates, etc. A good e-commerce platform will be user-friendly, simplifying web design with things such as ready-made templates and drag-and-drop builders.

Since a lot of B2B is service-based, such as accounting or marketing, this keeps options open. Dropshipping can be an appealing business model for small business owners in the e-commerce space because it removes the need to manage inventory yourself. BigCommerce caters to this space with its ready-made database of dropshipping suppliers.

Catégorie: Bookkeeping | Tags:

6 1: Introduction to Variable Costing Analysis Business LibreTexts

The marginal cost will take into account the total cost of production, including both fixed and variable costs. Since fixed costs are static, however, the weight of fixed costs will decline as production scales up. Since variable costs are tied to output, lower production volume means fewer costs are incurred, which eases the cost pressure on a company — but fixed costs must still be paid regardless.

As a consultant, you’ll be spending most of your time dealing with a company’s P&L (or the income statement). Because your job is to identify revenue or savings that will drop to the bottom line. And as we’ve already established, cutting variable costs (i.e. outsourcing, replacing parts, optimizing processes) is much easier than cutting fixed costs. You’ll be dealing a lot with these costs throughout your time as a consultant. So get familiar now with how these costs impact a business, and how a variable-cost-based business model differs from a fixed-cost-based business model. One of those cost profiles is a variable cost that only increases if the quantity of output also increases.

This can make it somewhat more difficult to determine the ideal pricing for a product. In turn, that results in a slightly higher gross profit margin compared to absorption costing. One of the essential limitations of variable costing is that it does not comply with Generally Accepted Accounting Principles (GAAP) for external financial reporting or financial statements. It represents the variable manufacturing cost incurred for each unit produced or for each unit of service provided. It’s essentially the cost that varies with changes in production or activity levels. Let us see one more example to calculate the total variable cost and its dependency on quantity.

Based on our variable costing method, the special order should be accepted. Some of the most common variable costs include physical materials, production equipment, sales commissions, staff wages, credit card fees, online payment partners, and packaging/shipping costs. For example, if you have 10 units of Product A at a variable cost of $60/unit, and 15 units of Product B at a variable cost of $30/unit, you have two different variable costs — $60 and $30.

Total variable cost equals the quantity of output into variable cost per output unit. If Amy were to shut down the business, Amy must still pay monthly fixed costs of $1,700. If Amy were to continue operating despite losing money, she would only lose $1,000 per month ($3,000 in revenue – $4,000 in total costs). Therefore, Amy would actually lose more money ($1,700 per month) if she were to discontinue the business altogether.

- After you have determined the average for each variable expense, add a buffer to it.

- Therefore, a company can use average variable costing to analyze the most efficient point of manufacturing by calculating when to shut down production in the short-term.

- Public companies are required to use the absorption costing method in cost accounting management for their COGS.

- This refers to the quantity of goods manufactured or the level of service provided.

- Some of the most common variable costs include physical materials, production equipment, sales commissions, staff wages, credit card fees, online payment partners, and packaging/shipping costs.

Compare your actual expenditure for each variable expense to the budgeted amount. Look for the areas where the expenditure went over budget or under budget for each expense category. Variable costing offers several key concepts and highlights, making it an important apparatus for internal decision-making and performance evaluation. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. Apps like PayPal typically charge businesses per transaction so customers can check out purchases through the app.

Variable Costing in Financial Reporting

A company produces 1000 boxes at an average cost of production of one unit is $20. For example, raw materials may cost $0.50 segmentation per pound for the first 1,000 pounds. However, orders of greater than 1,000 pounds of raw material are charged $0.48.

Absorption Costing vs. Variable Costing Example

Unlike absorption costing, variable costing doesn’t add fixed overhead costs into the price of a product and therefore can give a clearer picture of costs. By assigning these fixed costs to cost of production as absorption costing does, they’re hidden in inventory and don’t appear on the income statement. A variable costing income statement is a financial report in which you subtract the variable expenses from revenue, resulting in a contribution margin. The contribution margin is the incremental profit earned when a product’s sales exceed its variable costs. The income statement we will use in not Generally Accepted Accounting Principles so is not typically included in published financial statements outside the company. This contribution margin income statement would be used for internal purposes only.

Variable costing focuses more on short-term decision-making because it avoids fixed manufacturing costs. For long-term strategic decisions, absorption costing may give a more accurate picture of overall costs and productivity. To do this, divide the total variable cost for that category by the number of units produced. This refers to the quantity of goods manufactured or the level of service provided. It’s the measure of production or activity to which variable costs are linked. To utilize this equation, you must determine the variable cost per unit (VCU).

Variable Cost Explained in 200 Words (& How to Calculate It)

High variable cost businesses primarily focus on increasing their pricing power (think Coach). For each handbag, wallet, etc. that Coach produces, it incurs a variable cost. To maximize each unit of production, Coach has branded its products as a luxury item and charges a premium for each unit of production. High prices, versus high volume at a lower price, is how Coach maximizes profitability. While it usually makes little sense to compare variable costs across industries, they can be very meaningful when comparing companies operating in the same industry. They denote the amount of money spent on the production of a product or service and are among the most important analyses a business (or consultant) can run.

The firm’s specific needs, objectives, and reporting needs should guide the decision between variable costing and absorption costing. Many businesses employ both techniques to grasp their cost structures and profitability for various reasons fully. Variable costing focuses on calculating the costs that vary with changes in production levels. Cost-volume-profit (CVP) analysis is a tool frequently related to variable costing. It helps businesses understand how changes in sales volume will affect their profits. If Amy did not know which costs were variable or fixed, it would be harder to make an appropriate decision.

While determining the annual average for the variable expense, instead of looking into the last 12 months’ figures, take into consideration the average of 3 years’ worth of expenses. This will help you account for anomalies that may impact your variable expenses. Now, there are unicorn businesses that can charge a premium price and drive volume (think Apple). Commissions are often a percentage of a sales proceed that is awarded to a company as additional compensation. Because commissions rise and fall in line with whatever underlying qualification the salesperson must hit, the expense varies (i.e. is variable) with different activity levels.

Therefore, we should use variable costing when determining whether to accept this special order. Understanding the variable costs per unit formula and its applications can help businesses make informed decisions about pricing, production, and profitability. By calculating the variable https://www.wave-accounting.net/ costs per unit, businesses can determine the minimum price they need to charge to cover their costs and make a profit. Variable costs refer to the direct costs and variable overhead incurred during the production or manufacturing of a product or service, excluding all fixed costs.

Therefore, if a company uses variable costing, it may also have to use absorption costing (which is GAAP-compliant). For businesses with complex product lines or different cost centers, allocating variable costs precisely to specific products or ventures can be challenging. Determining which costs are truly variable and which are settled can be a complex assignment in a few cases.

Catégorie: Bookkeeping | Tags:

Service commercial : 01 80 88 43 02

Service commercial : 01 80 88 43 02