How to record a credit card payment

To create the sales journal entry, debit your Accounts Receivable account for $240 and credit your Revenue account for $240. Like in a cash sales journal entry, you likely also will deal with sales tax. Realistically, the transaction total won’t all be revenue for your business. The transaction will increase cash at bank balance of $ 100 and the other income for the same amount. However, it is recorded as the other income which does not impact the company performance.

How the credit card sales process works

They are recording a single credit card single statement into the credit issuer’s account, such as Amex or Bank of America. When you sell something to a customer who pays in cash, debit your Cash account and credit your Revenue account. Credit Card Reward is the amount of cashback that the credit card company or bank provides to customers to encourage their spending using the card.

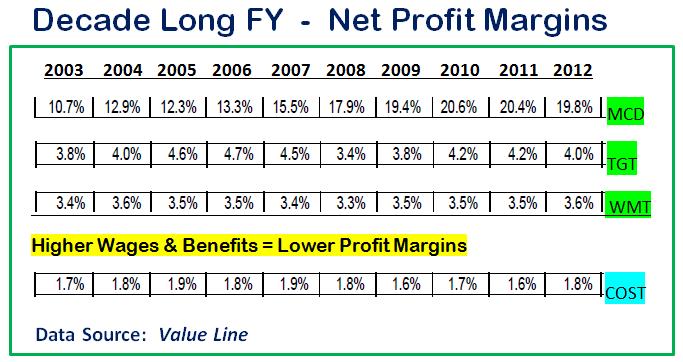

- In table 1, which side is credited and which side is debited is shown.

- Credit Card Expense accounts are expense accounts, so they are also increased by debits and decreased by credits.

- The credit card issuer will have an account in its accounting system with your name.

Consider, for example; you use your credit card to purchase an item of clothing. This will generate a credit card statement which will be sent to the credit card issuer. Assuming everything is clear on your side and that you have not exceeded your credit card limit, the detailed entry of purchase enters the credit card issuer’s accounting system.

Accounting and Journal Entry for Credit Card Sales

This leads to a faster transaction and a change in how this transaction is noted in the statements of the credit card issuer. Table 1 below shows the transaction that would be noted in the accounting journal of the credit general and special accounting journals card issuer. The two scenarios shown in figure 1 for the accounting journal entry are when the credit card holders pay cash immediately and when the credit card holders pay at a later date. As a refresher, debits and credits affect accounts in different ways. Assets and expenses are increased by debits and decreased by credits.

Regardless of whether you receive immediate or delayed payment, use the Cash, Credit Card Expense, and Sales Revenue accounts. However, only use the Accounts Receivable account for delayed payments. In some cases, you might be able to pass along swipe fees to customers. But, some state laws prohibit businesses from passing along these fees.

Journal Entry for Credit Card Rewards

The entry is increasing fixed assets $ 5,000 as the furniture arrives and is ready to use. It also increases the liability $ 5,000 which needs to settle in the future. The usual transfer time is 3-5 days, and sometimes, it may take even more time. There may even be some commission involved with the transfer. The retailer would have to pay the commission fee out of their own profits.

If the crediting remaining is not sufficient or the credit card is blocked for some reasons, the card will usually be denied by the processing machine resulting in no sale through credit card to begin with. And if the sale is made through, the bank will directly deposit money to the company’s account within a few days if not within a day after deducting necessary credit card fee. Likewise, the company can make the Journal entry for sale through debit card the same as the credit card sale by debiting the types of accounts assignment help homework help online live cash account and the credit card fee account and crediting sales revenue account. Company ABC has used a credit card to pay for some small payments online. During the month, company receives cashback of $ 100 due to last month’s purchase. Accountant is seeking advice to record the cashback reward.

The cash is paid immediately when the credit card holder purchases something from a retailer that has a point of sale or a POS system. The retailer and credit card holder would need to confirm the purchase before cash was deposited into the bank account of a retailer. On the other side, when you pay your credit card bills, the issuers move the credit from its account to your account. So, in this way, credit cards work similarly to how a bank account works, but the position of credit card user and credit card issuer is reversed.

Remember that your debit and credit columns must equal one another. As a result, you must increase your Accounts Receivable account instead of your Cash account. Your Accounts Receivable account is the total amount a customer owes you. Later, when the customer does pay, you can reverse the entry and decrease your Accounts Receivable account and increase your Cash account. When you offer credit to customers, they receive something without paying for it immediately. Moreover, other income is not related to company performance, it is recorded in the statement of comprehensive home office expense income.

Use the chart below to see which types of accounts are increased and decreased by debits and credits. Nowadays payer banks issuing credit card machines (also known as Point of Sale terminals) automate the entire process. This means that the cash is credited automatically to the firm’s current account and no manual settlement is required. The customer charges a total of $252 on credit ($240 + $12).

: Bookkeeping | Tags:

Vous pouvez suivre les prochains commentaires à cet article grâce au flux RSS 2.0

Service commercial : 01 80 88 43 02

Service commercial : 01 80 88 43 02

Répondre

Désolé vous devez être connecté pour publier un commentaire.