Archives de mars, 2022

Железобетонные ставки что значит ЖБ в ставках на спорт?

Чаще всего под гарантированный проход попадают исходы с перевесом, где встречаются фаворит и аутсайдер. Также такое пари может быть привязано к конкретной новости. Опытный игрок, проведя анализ, для себя подчеркнул, что фаворит может столкнуться с проблемами, т.к. В его составе отсутствуют несколько ключевых игроков группы атаки. В этой ситуации он «подкупит» плюсовую фору «Саутгемптона» до (+2,5) и назовет такую ставку железкой. Ведение детального журнала всех совершенных ставок позволит вам анализировать как успешные, так и неудачные решения.

Что значит железобетонная ставка?

Растущая популярность ставок на спорт в Украине привела к увеличению числа игроков, пользующихся услугами местных букмекеров. Ожидается, что отрасль будет продолжать развиваться, поскольку на рынок выходит все больше букмекеров, предлагающих клиентам новые и инновационные услуги. Можно заметить, что в разных компаниях могут выставляться различные коэффициенты на одни и те же исходы. Где-то более высокий «кэф» связан с тем, что у конторы скромнее маржа, а где-то просто с расхождением в аналитике.

Основные стратегии ставок на футбол Хозяева/гости

Среди популярных состязания команд CS GO, Лига легенд, Dota 2, Starcraft. Беттерам предлагаются перспективные коэффициенты, лояльная маржа и множество прогнозов — как общих, так и соответствующих специфике. Это сайты, являющиеся точными копиями официальных площадок. При обнаружении зеркала также блокируются, поэтому их адреса постоянно меняются. Но приходится, поскольку этим гусарским приемом продолжают пользоваться наши современники.

Плюсы и минусы ставок на футбол онлайн

Поэтому страховаться от ЖБ-ставок букмекерам не требуется. Ставки на футбол на сегодня и каждый день ближайшей недели представлены бесплатно для каждого матча высших дивизионов всех ведущих европейских Лиг. Кроме того, доступны прогнозы и на сильнейшие первенства Южной и Северной Америки.

- В последние годы индустрия спортивных ставок в Украине претерпела значительные изменения, с легализацией онлайн-ставок в 2020 году.

- Концептуально это мало чем отличается от обычной игры равномерными ставками, хоть беттер этого и не осознает.

- С помощью системы ранжирования и серьезных и консолидированных стандартов мы делаем оценку лучших легальных сайтов для ставок в Украине.

- Ставки на события с вероятностью 50-60% (коэффициенты 1.7 — 2) следует делать в размере около 5% от игрового банка.

- Перед началом заработка на ставках важно задуматься, действительно ли это ваш путь.

- « Железка » представляет собой ставку, в которой игрок имеет абсолютное доверие к положительному исходу.

Лучшие легальные онлайн букмекеры в Украине

Всегда определяйте размер ставки в зависимости от состояния вашего банкролла. Это поможет минимизировать риски потерь и увеличить потенциальную прибыль. Избегайте рискованных ставок, ставя всю сумму на один исход. Если же ваша цель — заработок, будьте предельно честны с собой. Не ленитесь вести учет своих ставок и строго следуйте выбранной игровой и финансовой стратегии.

Прогнозы

Перечисленные в рейтинге БК предлагают одни из самых лучших коэффициентов на украинском рынке, при этом маржа оказывается достаточно лояльной. Лучшие букмекеры Украины с пониманием относятся к увлечению беттеров, но в то же время предупреждают их о необходимости ответственной игры. Вилочную схему используют, чтобы получить прибыль вне зависимости от того, чем закончится встреча игроков или команд. Вилочники отслеживают завышенные по тем или иным причинам коэффициенты и, пока букмекер не изменил их в соответствии с условиями рынка (других БК), спешат сделать ставку.

Ставки на спорт – это всегда рискованное занятие, и никакой прогноз не может дать гарантии успеха. Поэтому важно принимать ставки осознанно и не выходить за пределы своих финансовых возможностей. Также важно поддерживать консистентность в ваших ставках. Не стоит сегодня делать одну ставку, а завтра – раскидываться по всем доступным событиям. Ограничьтесь разумным количеством ставок, которые вы способны качественно проанализировать, и избегайте погони за « самой лучшей » ставкой. Невозможно охватить все возможные варианты, как и нельзя стать экспертом во всех видах спорта.

Это вовсе не говорит о том, что нужно опустить руки назвать эту сферу непредсказуемой, непрогнозируемой. Следует лишь все свои стратегии планировать так, чтобы этот любой проигрыш, в самый неподходящий момент, не приводил к катастрофе. Напротив, сам факт того, что любая из ваших ставок может проиграть, нужно заложить в саму идею стратегии. Раз это неизбежно и не всегда предсказуемо, требуется прописать граничные пределы, допустимый процент этих проигрышей. Конечно, стараться снижать его, стремиться к повышению проходимости. Чтобы выпадали только ставки из-за форс-мажоров, а собственные ошибки в прогнозах свести к минимуму.

Если клиент букмекерской конторы обнаружил в линии букмекера ставку, которая, по его мнению, обязательно сыграет, он назовет ее железкой и железной ставкой. Перед началом заработка на ставках важно задуматься, действительно ли это ваш путь. Стать миллионером и уехать в Испанию за счет выигрышей в букмекерской конторе маловероятно.

Наверное, каждый беттер мечтает оформлять пари с почти 100% уверенностью в правильности выбранного исхода. На сленге игроков такие ставки называют «железобетонными». В словаре игрока « Железобетон » – это ставка с высокой проходимостью, в которой беттор уверен, что пари зайдет и принесет 100% прибыль. Термин основан на особенностях https://kidrights.kherson.ua/ железного металла – прочности, надежности и устойчивости. Опытные игроки постоянно изучают линии букмекерских контор, пытаясь найти там железки.

Железные прогнозы полезны при игре на ставках, но беттеру стоит рассматривать их как подспорье в принятии собственного решения. В результативных чемпионатах можно опробовать систему ставок на голы. В топ-чемпионатах по футболу близкие к жб ставки можно найти в матчах явных фаворитов. Также хорошо работают «верняки» в матчах теннисистов первой десятки ATP и WTA.

Рубрики

Предположим, что игроку приглянулся матч, в котором сыграет «Ливерпуль» и «Саутгемптон». Расклад перед матчем и котировки БК указывают на то, что «Ливерпуль» одержит уверенную победу. Также нужно уметь расставлять приоритеты, ведь самый безнадежный игрок может одержать победу, если настроится на игру. Для предотвращения эмоциональных ставок всегда оставайтесь объективными и придерживайтесь заранее разработанной стратегии. Избегайте ставок, основанных на личных предпочтениях или эмоциях. В спорных случаях клиент может обратиться в службу поддержки.

Приветственный бонус для новых игроков

В Украине доступно несколько способов оплаты, включая кредитные и дебетовые карты, банковские переводы, электронные кошельки и мобильные платежи. В целом, регистрация на сайте спортивных ставок в Украине – это простой и понятный процесс, который обеспечивает ряд преимуществ как для бетторов, так и для букмекеров. Чтобы подтвердить свою личность, клиент загружает фото паспорта или другого принадлежащего ему документа. Некоторые букмекеры просят сделать селфи с паспортом или банковской картой в руках. В редких случаях дополнительно беттер участвует в Скайп-конференции с менеджером конторы.

Catégorie: Ставки на спорт | Tags:

What to Do if You Think Someone is Overdosing Stop Overdose

A person can still experience the effects of an overdose after a dose famous people who died from alcoholism of naloxone wears off. Because of this, it’s essential to call 911 for the person so they can get immediate medical care. Anyone who uses opioids could potentially experience an opioid overdose. Overdoses can happen to people during their first time using opioids, to people who’ve taken them multiple times or to people who have opioid use disorder. Drug overdose is the leading cause of accidental death in the United States, with opioids being the most common cause.

People can also die from opioid overdose when they (knowingly or unknowingly) use an opioid in combination with another substance, such as a sedative or stimulant. These combinations create a level of toxicity in your body that’s deadly. While North America currently has the highest rate of opioid overdoses in the world, opioid overdose continues to be a global issue. Learn the value of harm reduction and how you can help prevent overdoses in your community. Fentanyl Test strips are a harm reduction tool that detects the presence of fentanyl mixed into a substance, such as cocaine or heroin. You can learn more about overdoses from cocaine and other stimulants, which often rebuilding your life after addiction involve fentanyl, from this report issued by the OASAS Medical Advisory Panel.

- Police officers, emergency medical technicians and first responders carry and have training on how to give naloxone.

- They also perform other tests to assess the health of the person and to look for possible complications.

- People experiencing an opioid overdose need naloxone (commonly known by the brand name Narcan®).

- An online and mail-based harm reduction platform that deliveries harm reduction supplies to New Yorkers outside of New York City.

If the person is still unresponsive and not breathing after administering a second dose of naloxone, you should continue supporting their breathing as best you can. If you suspect a person has overdosed, but you’re not sure what substance they’ve used, you should still give them a dose of naloxone just in case they have opioids in their system. If they didn’t take opioids, naloxone is still safe — it just won’t have any effect.

How common are opioid overdoses?

If you use prescription drugs, be sure to use them only as directed by your doctor. Do not combine any medications without first asking your doctor if it’s safe. You should also not mix alcohol with prescription drugs without checking with your doctor first. An overdose can lead to serious medical complications, including death. The severity of a drug overdose depends on the drug, the amount taken, and the physical and medical history of the person who overdosed.

Stay with the person until emergency services arrive

It can be difficult for people who use opioids or other substances to know what to expect when using nonmedical forms of opioids. This is because when they’re not regulated medically, they often have varying levels of potency. Using unregulated opioids increases someone’s chances of overdose and death from overdose.

An opioid overdose happens when opioids negatively affect the part of your brain that regulates breathing, resulting in ineffective breathing. A person experiencing an opioid overdose needs naloxone and immediate medical care to prevent death. Opioid overdoses are medical emergencies that require quick diagnosis and treatment. Because of this, first responders and people who are trained to administer naloxone (Narcan®) mainly rely on symptoms and personal history to diagnose them. As the person experiencing an overdose is usually unconscious, providers rely on bystanders or loved ones to tell them if the person has a history of substance use.

This rise is due to the increased use of prescription narcotics as pain medication and the contamination of nonmedical opioids and other substances with highly potent opioids like fentanyl. Using any kind of opioid has the potential to result in opioid overdose, whether it’s a prescription or nonprescription opioid. About 75% of opioid overdoses are due to nonmedical use of synthetic opioids — mainly forms of nonmedical fentanyl. The healthcare provider may be able to use an antidote for certain drug overdoses. For example, the drug naloxone can help reverse the effects of a heroin overdose. It’s important to note that the effects of naloxone only work for 30 to 90 minutes, but after that time, a person can overdose again if opioids are still in their system.

A drug overdose is taking too much of a substance, whether it’s prescription, over-the-counter, legal, or illegal. If you’ve taken more than the recommended amount of a drug or enough to have a harmful effect on your body’s functions, you have overdosed. Anyone can overdose, especially when using drugs for the first time or using after a period of not using. If you have overdosed previously, gas x and alcohol interaction you are much more likely to overdose again. If you do use alone, make sure someone knows where you are and that you are using so that they can check on you by phone/text and notify 911 if you don’t respond.

Lifestyle Quizzes

Overdoses are most common among those who use opioids and may be increasing in some populations or areas recently in the context of COVID-19. Drug overdoses from other drugs (e.g., cocaine, methamphetamine) have also been increasing, largely due to the mixing of these drugs with opioids such as fentanyl. Factors that increase the risk of overdose and death include drug use following a drug-free period, mixing substances, using alone, and having other medical conditions such as lung or heart conditions. If you or someone you know uses opioids, it’s important to carry naloxone in case of an overdose.

How to Find Help for Substance Misuse

If you or a loved one has opioid use disorder, talk to a healthcare provider as soon as possible. A trained provider can help guide you to the treatment you need. Opioid use disorder is a medical condition — it requires care just like any other condition.

Catégorie: Sober living | Tags:

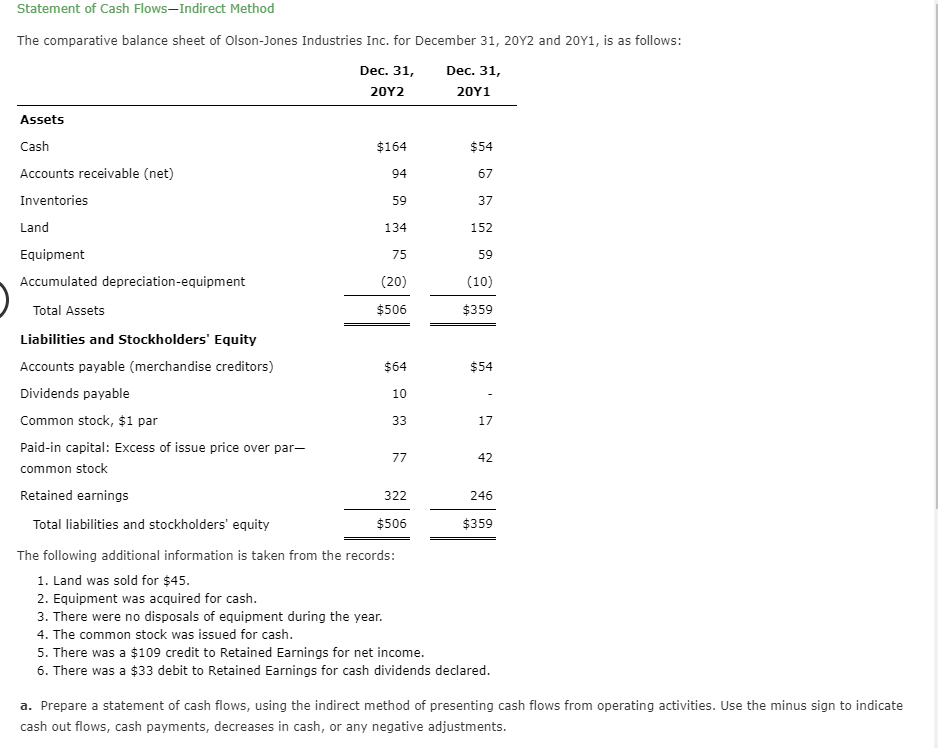

What are Retained Earnings? Guide, Formula, and Examples

During the current financial period, the company made a net income of $30,000. The retention ratio may change from one year to the next, depending on the company’s earnings volatility and dividend payment policy. Many blue chip companies have a policy of paying steadily increasing or, at least, stable dividends. Companies in defensive sectors such as pharmaceuticals and consumer staples are likely to have more stable payout and retention ratios than energy and commodity companies, whose earnings are more cyclical. If the company has been operating for a handful of years, an accumulated deficit could signal a need for financial assistance.

- But retained earnings provides a longer view of how your business has earned, saved, and invested since day one.

- Once you consider all these elements, you can determine the retained earnings figure.

- In the world of finance, understanding Retained Earnings is crucial for investors and business owners alike.

- Where cash dividends are paid out in cash on a per-share basis, stock dividends are dividends given in the form of additional shares as fractions per existing shares.

- You can find the beginning retained earnings on your Balance Sheet for the prior period.

It shows a business has consistently generated profits and retained a good portion of those earnings. It also indicates that a company has more funds to reinvest back into the future growth of the business. Most software offers ready-made report templates, including a statement of retained earnings, which you can customize to fit your company’s needs. These programs are designed to assist small businesses with creating financial statements, including retained earnings. Retained earnings, on the other hand, refer to the portion of a company’s net profit that hasn’t been paid out to its shareholders as dividends. Retained earnings, at their core, are the portion of a company’s net income that remains after all dividends and distributions to shareholders are paid out.

Q. Can a company have negative Retained Earnings?

They do not provide a forward-looking view of a company’s performance or potential risks. To make informed investment decisions, consider combining historical data with future projections and industry analysis. Since retained earnings demonstrate profit after all obligations are satisfied, retained earnings show whether the company is genuinely profitable and can invest in itself.

It’s best to utilize the retention ratio along with other financial metrics to determine how well a company is deploying its retained earnings into investments. The retention rate for technology companies in a relatively early stage of development is generally 100%, as they seldom pay dividends. But in mature sectors such as utilities and telecommunications, where investors expect a reasonable dividend, the retention ratio is typically quite low because of the high dividend payout ratio.

What Makes up Retained Earnings?

In the world of finance, understanding Retained Earnings is crucial for investors and business owners alike. This financial term holds the key to a company’s financial health and growth prospects. In this article, we’ll delve into the fundamentals of Retained Earnings, explaining what it is, how to calculate it, and why it matters. Retained earnings offer valuable insights into a company’s financial health and future prospects. When a business earns a surplus income, it can either distribute the surplus as dividends to shareholders or reinvest the balance as retained earnings. To arrive at retained earnings, the accountant will subtract all dividends, whether they are cash or stock dividends, from the total amount of profits and losses.

How to Find SKU Numbers and Use Them for Effective Inventory Management

Ensure your investment aligns with your company’s long-term goals and core values. Perhaps the most common use of retained earnings is financing expansion efforts. This can include everything from opening new locations to expanding existing ones. While retained earnings can be an excellent resource for financing growth, they can also tie up a significant amount of capital.

Unlike the income statement which uses accrual accounting, the cash flow statement provides a real-time view of the company’s cash situation. The retention ratio is the proportion of earnings kept back in the business as retained earnings. The retention ratio refers to the percentage of net income that is retained to grow the business, rather than being paid out as dividends. It is the opposite of the payout ratio, which measures the percentage of profit paid out to shareholders as dividends. The level of retained earnings can guide businesses in making important investment decisions.

Therefore, a company with a large retained earnings balance may be well-positioned to purchase new assets in the future or offer increased dividend payments to its shareholders. In the next accounting cycle, the RE ending balance from the previous accounting period will now become the retained earnings beginning balance. Your accounting software will handle this calculation for you when it generates your company’s balance sheet, statement of retained earnings and other financial statements. The calculated retained earnings represent the net amount of your business’s profits that have been reinvested or held back for future use. A positive retained earnings figure indicates that the business has accumulated profits over time, signifying healthy business performance. On the contrary, negative retained earnings may signify accumulated losses over time, which could be a sign of concern.

If a company has a high retained earnings percentage, it keeps more of its profits and reinvests them into the business, which indicates success. This financial metric is just as important as net income, and it’s essential to understand what it is and how to calculate it. This article breaks down everything you need to know about retained earnings, including its formula and examples. But while the first scenario is a cause for concern, a negative balance could also result from an aggressive dividend payout, such as a dividend recapitalization in a leveraged buyout (LBO). The “Retained Earnings” line item is recognized within the shareholders equity section of the balance sheet.

If a company has negative retained earnings, its liabilities exceed its assets. In this case, the company would need to take action to improve its financial position. Finally, companies can also choose to repurchase their own stock, which reduces retained https://personal-accounting.org/ earnings by the investment amount. By understanding these factors, your business can make informed decisions about how to manage its retained earnings. Some companies use their retained earnings to repurchase shares of stock from shareholders.

For an analyst, the absolute figure of retained earnings during a particular quarter or year may not provide any meaningful insight. Observing it over a period of time (for example, over five years) only indicates the trend of how much money a company is adding to retained earnings. Revenue is the money generated by a company during a period but before operating expenses and overhead costs are deducted. In some industries, revenue is called gross sales because the gross figure is calculated before any deductions.

In financial modeling, it’s necessary to have a separate schedule for modeling retained earnings. The schedule uses a corkscrew-type calculation, where the current period opening balance is equal to the prior period closing retained earnings equation balance. In between the opening and closing balances, the current period net income/loss is added and any dividends are deducted. This helps complete the process of linking the 3 financial statements in Excel.

The statement starts with the beginning balance of retained earnings, adds net income (or subtracts net loss), and subtracts dividends paid. Another factor influencing retained earnings is the distribution of dividends to shareholders. When a company pays dividends, its retained earnings are reduced by the dividend payout amount. So, if a company pays out $1,000 in dividends, its retained earnings will decrease by that amount.

Catégorie: Bookkeeping | Tags:

Paying Your Tuition University of Texas at Austin

A $25 late charge is assessed for second and third installment payments received after the due date. If you select the installment plan and subsequently receive a financial aid award, your total tuition and fees will be deducted from your award at the time of disbursement. If, for any reason, the expected financial aid is not available to pay the registration fees by the twelfth class day, you must make other arrangements to pay fees by that date. After you have completed your add/drop transactions, go to My Tuition Bill for an add bill quote. If the changes you made in your schedule result in the assessment of additional tuition and/or fees, you must make payment via the Web as in the preceding paragraph, or by check or money order. Checks and money orders may be deposited in the drop slot near the entrance to MAI 12.

If something happens to a student’s ID card, it can immediately be deactivated online to protect Bevo Pay funds. Cardholder statements detailing every transaction are available online and can be seen by a student or eProxy. There are no monthly maintenance https://cryptolisting.org/ fees, minimum balance requirements or transaction charges. The second and third installments each consist of one-half of the remaining balance, adjusted for adds and drops. Bills for these payments are sent to the student’s e-mail address.

- Selection of the three-payment installment plan constitutes an agreement to pay the remaining tuition and fees on time.

- Your request will not be processed unless you submit the documentation to D&A.

- Tuition and financial bars cannot be paid by electronic funds if you have a « no personal check » restriction with Student Accounts Receivable.

- Learn more about the complete accommodation request process through D&A.

- Go to My Tuition Bill online to charge the total amount due to your MasterCard, Discover, or American Express card.

If you do not receive your fee bill, it is still your responsibility to complete registration by the deadline on the Student Accounts Receivable Web site. Your registration is not complete until you have gone to My Tuition Bill and made arrangements to have your tuition/fee bill paid. If you do not pay your fee bill in full or indicate that you are paying via financial aid or a third party, you are not registered and you may not attend classes or use University services.

An eProxy is authorized by service (so you may be authorized for one service but not another), and each authorization is valid for up to one year as specified by the granter. The ID Center provides ID cards for students, faculty, staff, official visitors and university affiliates ut eproxy as required. The ID Center also upgrades UT EIDs for eligible individuals to allow full access to online services. If you have a zero ($0.00) tuition bill, you still need to confirm your attendance by clicking the “Confirm Attendance” button on My Tuition Bill before the 5 p.m.

If you do not receive your tuition bill, it is still your responsibility to complete registration by the deadline on the Student Accounts Receivable Web site. For undergraduates who register by 4 Jun, full payment or confirmation of attendance must be received by 5pm on 4 Jun. Undergraduates who register after 4 Jun must make payment or confirm attendance by the deadline specified under Registration Procedure Summaries or as instructed at the time of registration.

There are several ways to pay for your UT education. Find information here on how to pay online, in person or by mail, using financial aid or outside loans. If you are paying by eCheck or electronic funds transfer, go to My Tuition Bill online. The housing contract and your monthly installments include fall, winter and spring break periods. Dobie Twenty21 does not close for these break periods, and we do not prorate the installments. Yes, it is deducted from your first housing payment installment.

Continuing and Transfer Student Scholarship Application

Whenever you register, review your methods of payment or our payment plans. A 1.75% convenience charge will be added to all tuition and mandatory fee payments made by credit card. We prioritize incoming first-time freshmen in our contract process.

Pay in Person

You are able to submit preferences for your residence hall, bathroom type and roommate(s). You can also apply for Living Learning Communities (LLCs). Are you a future Longhorn coming to campus for your first year? Learn everything you need to know about applying to live in our residence halls.

Fee bill quotes may be requested from Student Accounts Receivable. The room selection process is administered with rooms labeled by gender and provides available bed spaces based on your gender marker with the university. The Course Schedule is published before advising and registration begin for each semester and summer session.

Sending a Transcript for UT transfer credits

As long the student is currently enrolled in the University, they must leave their money in their Bevo Pay account. Cash payments must be presented to the cashiers in MAI 8 before 5p on the payment deadline. Cash payments must be presented to the cashiers in MAI 8 before 5pm on the payment deadline. Dobie Twenty21 features a select number of single spaces. If you request a single space and we are unable to accommodate your request, you will be offered a different type of space. Interested in living on campus in an apartment-style residence?

International Student “Check-in”

Undergraduates must make payment no later than 5p, Thu 5 Jan. Graduate and professional students must make payment no later than 5p Fri 20 Jan. Undergraduates must make payment no later than 5pm, 15 May. Graduate and professional students must make payment no later than 5pm 6 Jun.

Graduate and professional students must make payment by 5pm on 6 Jun or as instructed at the time of registration. See above for information regarding methods of payment. If fee payment is not received by the deadline, your registration will be canceled.

Catégorie: Cryptocurrency service | Tags:

Days Sales Outstanding DSO Formula + Calculator

Similarly, companies offering extended payment terms (e.g., net 60 or net 90) might see a higher DSO compared to businesses that require payment within 30 days. In June, the vineyard dso meaning drew in $35,000 in ticket sales to its wrestling matches (a cash-only business). The company also sold $83,000 of wine—all of which was purchased on credit by distributors.

Benefits of Accounts Receivable Automation

Days sales outstanding is also sometimes referred to as “days sales in receivable”. By keeping a close eye on DSO, businesses can identify important trends, pinpoint issues in their credit policies or collection processes, and take corrective actions. For example, if your DSO is rising, it might signal that customers are taking longer to pay due to dissatisfaction with the product or service, financial difficulties, or too lenient credit terms. Addressing these issues promptly will help your businesses avoid cash flow crunches, ensuring you have the funds you need to thrive and grow. Days Sales Outstanding (DSO) is a crucial financial metric for accounts receivable that tells us how long, on average, it takes a company to collect payments from its sales on credit.

Financial reporting

Some will say that DSO and ACP are interchangeable metrics while others note subtle differences in their calculations. The more proactive you are in measuring days to collect, the easier it will be to spot cash flow problems early and address them before they start to impact your operational efficiency. To understand the effectiveness of your accounts receivables process, analyze individual DSO values, and review trends in DSOs over time.

Days Sales Outstanding Template

As a general rule of thumb, companies strive to minimize days sales outstanding (DSO), since it implies the current payment collection method is efficient. However, for a small-scale business, a high DSO is a concerning matter because it may cause cash flow problems. Smaller businesses https://www.bookstime.com/ typically rely on the quick collection of receivables to make payments for operational expenses, such as salaries, utilities, and other inherent expenses. They may struggle for cash to pay these expenses from time to time if the DSO continues to be at a high value.

Limitations of DSO calculation

- A closer relationship means more loyalty, repeat business, and better feedback on your product or services.

- In particular, it can tell us how effective the company is managing its working capital.

- If a company’s DSO is increasing, it’s a warning sign that something is wrong.

- Similarly, if your customer pool tends to work on larger projects with longer payment timelines, you might experience a DSO above 45 days but be well below the industry average.

- While this metric seems simple on the surface, you’ll want to customize the calculation to get more granular views for your business.

- Average DSO for companies across various industries in the third quarter of 2022.

Use an invoice template that includes all of these important details, like the invoices generated by QuickBooks’ free invoice generator, or free invoice templates. Analyze DSO over multiple periods (e.g., monthly or quarterly) to identify trends. Look for patterns or anomalies that may indicate issues or improvements in your receivables process. Cash sales have a DSO of zero, and you shouldn’t factor them into DSO calculations, as they will skew the metric. While DSO provides valuable insight into how quickly your business collects payments, it’s important to remember that it’s just one piece of the puzzle when evaluating your overall financial health.

Collection Effectiveness Index (CEI)

For newer businesses, or businesses that have limited cash flow, not tracking your DSO can have serious repercussions, including bankruptcy. In understanding Days Sales Outstanding (DSO), it’s crucial to recognize that there’s no one-size-fits-all number signifying excellent or poor accounts receivable management. This metric varies significantly across industries, influenced by distinct business models and payment practices. Broadly speaking, a DSO ratio of 45 days or fewer is often seen as ‘good’ for most companies. However, what constitutes a high or low DSO can differ markedly depending on the specific industry and company type.

- Monitoring DSO enables businesses to identify and address problem payers in the customer base and serves as a reminder to stay on top of unpaid invoices.

- On the flip side, Days Payable Outstanding (DPO) is the average time a company holds onto its cash before settling its own outstanding bills to vendors.

- The time it typically takes to collect payment from your customers after you’ve delivered a product or services.

- Fast credit collection means the money can be sooner used for other operations.

- You can delve deeper into these formulas in our DSO Calculation Blog, where we explore various methods for calculating Days Sales Outstanding, including real-world examples.

If they were factored into the calculation, they would decrease the DSO, and companies with a high proportion of cash sales would have lower DSOs than those with a high proportion of credit sales. Given the vital importance of cash flow in running a business, it is in a company’s best interest to collect its outstanding accounts receivables as quickly as possible. Companies can expect, with relative certainty, that they will be paid their outstanding receivables.

How to Calculate Days Sales Outstanding (DSO)

Regardless of the method, you’re using here, it will help you get an idea of where you stand. In our State of B2B Payments in 2024 report, the overall median DSO across industries is 56 days, but a closer look reveals significant variation, with some industries getting paid faster than others. At Upflow for example, we automatically calculate your DSO using the countback method when connecting your account with your invoicing solution. You can then track your DSO from your private dashboard without having to think about calculating it yourself. This metric allows you to track how much of your outstanding receivables are collected after their set due date, making it a telling indicator for forecasting the likelihood of bad debt.

How to Calculate Days Sales Outstanding and Why It Matters

Catégorie: Bookkeeping | Tags:

18 Best Accounts Receivable Automation Software Reviewed For 2024

Unlock faster payments from your customers, optimize payment controls, get an end-to-end audit trail, and automatically apply cash from payments to your General Ledger. Additionally, share a secure link in all communication, and provide access without requiring a password or profile creation. Customers can pay multiple invoices at once, view outstanding and paid invoices in one spot, and securely save payment details.

Not to mention, when you surround your variable overhead client with more services like AR automation, it becomes harder to leave you as well.

Why do you need AR automation?

This is one of the most popular features every AR automation software tends to have. Learn more about average collection periods and AR KPIs, and what makes sense for you to measure. You can make better strategic decisions when you are aware of these metrics (and have quick access to them) through automated dashboards. Your accounting department and finance team are familiar with the day-to-day AR operations so they are in the requirements for tax exemption best position to share the biggest gaps and challenges in the process. Even if you’re already utilizing general accounting software like QuickBooks, adding a dedicated AR automation solution is worth looking into.

Step 2: Connect to Your Cloud Accounting Software

Centime Positive Pay automates check issue file generation and delivery, which is used by banks to detect fraudulent checks written by businesses. Additionally, receive AR reports like the aging analysis, cashflow projection, and collection efficiency reports directly to your inbox and keep track of upcoming challenges and opportunities. The administrative burden of manual data entry and reconciliation processes can be time-consuming and prone to errors. Disputes and discrepancies in invoices require careful investigation and resolution to maintain healthy customer relationships. Centralize, manage, and automate end-to-end journal entry processes and freelancers 2021 retain supporting documentation in the cloud. Learn how Rebag, a luxury resale company that specializes in high-end handbags scaled B2B operations and reduce order processing time by 50…

Get paid faster, improve collections effectiveness, and reduce overdue payments directly within your ERP. Focus your collections efforts on the most impactful invoices for your business and unlock an accurate view of your future cash flows with Centime’s accounts receivable automation software. We help your team preserve adequate liquidity and predict payment delays with the use of AI. Accounts receivable automation refers to using technology to automate a variety of tasks and processes involved in managing the money owed to a business by its customers. This encompasses a range of activities, such as generating invoices, sending payment reminders, reconciling incoming payments, and producing financial reports related to receivables.

Accounts receivable automation is ultimately a software-enabled process that helps you manage your accounts receivables system more efficiently. This also improves cash flow and helps minimize the time and resources required for follow-up and collections. BlackLine is a unified cloud accounting platform for mid-sized to large firms. Our centralized customer payment portal benefits both you and your customers.

- AR automation benefits significantly streamline processes and enhance efficiency, making it an invaluable tool for modern accounting firms.

- When you have the right tools, AR automation will not only help your business grow, but it will also save you time.

- Customers can pay multiple invoices at once, view outstanding and paid invoices in one spot, and securely save payment details.

- Helping your clients collect their cash faster will deepen your relationship with them.

- SoftLedger is a comprehensive cloud accounting platform that has custom solutions for a wide variety of business sizes.

Think about the functionality you want and need in the system and make sure the software offers it. For example, Elson Materials outsourced and automated their accounts receivable management tasks and were able to create a full end-to-end AR workflow. Here are some other good options for automating accounts receivable processes. Standout features of SoftLedger include custom billing metrics that are well-suited to usage-based billing and other custom metrics.

Reduce DSO and Boost Working Capital

It allows users to pay vendors, suppliers, and any business bills, as well as send invoices and receive payments online. Xero is a cloud-based accounting platform that combines AR, AP, bookkeeping, and more. It targets the small business and contractor crowd, offering a relatively simple solution to meet the needs of smaller businesses. AR automation is a fantastic way to improve the financial performance and cash position of a business.

Specific solutions like Centime can smoothly integrate with major ERP systems, enhancing operational efficiency without disrupting existing workflows. By implementing AR automation tools, teams can significantly improve their workflow, ensuring faster and more reliable management of receivables. Since these reports give you data over a period of time, you can identify current irregularities in your collection process. You can also keep a track of customers who are making late payments regularly. Mapping your entire AR workflow will also help you understand what features you need from an accounts receivable automation software.

Catégorie: Bookkeeping | Tags:

10 of the Best Alcoholic Beverage for People with Diabetes

In people with diabetes, the pancreas does not produce sufficient insulin (type 1 diabetes) or the body does not respond appropriately to the insulin (type 2 diabetes). Alcohol consumption by diabetics can worsen blood sugar control in those patients. For example, long-term alcohol use in well-nourished diabetics can result in excessive blood sugar levels.

Referent-Specific Data

- So you may not know if your blood sugar is low or what you’re feeling is just the effects of the alcohol.

- The findings discussed here presents that the role of chronic use of alcohol on diabetes might be high of importance for clinical research and practice.

- The risks depend on how much alcohol a person consumes, as well as the type.

- However, whether these adverse effects in humans are mediated by changes in glycemic control and/or insulin action is far from clear.

- The two most common forms of DM are type 1 (T1DM) and type 2 diabetes, with T1DM accounting for approximately 10% of all cases in Caucasians [18].

Alcohol dependent subjects were found to have decreased plasma BDNF levels and impaired insulin resistance, which is a major pathogenic feature of T2DM. This might indicate that BDNF may be linked to the pathophysiology of T2DM after alcohol use. Ketoacidosis, which occurs primarily in diabetics, is a condition characterized by excessive diabetes and alcohol levels of certain acids called ketone bodies (e.g., acetone, acetoacetate, and β-hydroxybutyrate) in the blood. Elevated levels of those compounds can cause nausea, vomiting, impaired mental functioning, coma, and even death. Ketoacidosis is caused by complete or near-complete lack of insulin and by excessive glucagon levels.

Alcohol and your weight

Initially, resistance can be overcome by increasing insulin production. A deficit in insulin secretion, coupled with the state of insulin resistance, leads to T2DM [20]. https://ecosoberhouse.com/ Therefore, T1DM is characterized by a complete lack of insulin production, whereas, T2DM is characterized by a reduction of insulin production plus resistance [21].

2. Insulin Secretion and Plasma Concentrations

In an average person, the liver breaks down roughly one standard alcoholic drink per hour. Any alcohol that the liver does not break down is removed by the lungs, kidneys, and skin through urine and sweat. If someone chooses to consume alcohol, they should have food with it and keep a close watch on their blood sugar.

For example, neither a single oral dose of alcohol [93] nor a 4 h intravenous infusion altered plasma insulin concentrations determined 12 h later. Similarly, no change in the plasma insulin concentration was reported in chronic alcohol-fed rats [14,57], which is consistent with the lack of a significant change in pancreatic insulin content [89]. Additionally, 1–3 weeks of moderate alcohol consumption in humans did not alter the basal insulin concentration [61,87] and plasma insulin did not differ after long-term moderate alcohol intake [96]. The relationship between the magnitude of alcohol consumption and basal insulin concentrations may also be J- or U-shaped. For example, mild to moderate alcohol consumption in humans has been repeated demonstrated to decrease fasting insulin levels relatively to subjects consuming no/low alcohol and/or those with a high alcohol intake [22,23,24,109,110]. Drinking alcohol while taking Ozempic (semaglutide) is a topic that warrants careful consideration, according to published research.

You can save your life by drinking slowly

Treatment for Alcohol Addiction

What to know about type 2 diabetes and alcohol

- People with diabetes should be particularly cautious when it comes to drinking alcohol because alcohol can make some of the complications of diabetes worse.

- In addition, alcohol consumption may excessively raise or lower your blood sugar levels, depending on the drink and whether you have eaten recently (2).

- Don’t use dangerous equipment, or engage in activities that require coordination, concentration, or alertness.

- “You need to know if your medications or any diabetes-related conditions you have could be seriously affected by alcohol consumption,” emphasizes Harris.

Catégorie: Sober living | Tags:

Service commercial : 01 80 88 43 02

Service commercial : 01 80 88 43 02