Archives de février, 2021

Accounting Outsourcing: How to Hand off Your Financial Tasks With Recommendations Bench Accounting

You can choose Bench if your business has not entered the growth stage yet and it will take some time for your financials to change. When you scroll through their site you will not be able to find pricing information for their services but instead, you will be able to book a free consultation with them. Depending on the services you require, you will then be given a customized plan. This is their automated accounting feature and you can access all information through the real-time accounting dashboard. For each additional service that you choose like Payroll, tax, back office, and CFO advisory, you will have to pay an additional charge for each and each of them is priced differently.

If you are a VC-backed company, Pilot is a good choice for you as they provide financial support to such startups. You might also be eligible for discounts on their plans if you are a pre-revenue company. With the many integrations that Bookkeeper360 offers, you can also find many solutions for back-office processes like inventory control, managing invoices, payments, and lendings. If you are just starting and need someone to set up your payroll, Bookkeeper360 will help you. You can also integrate with payroll management software like Gusto and ADP so that your payroll and bookkeeping can be accessed from one place. If you have any questions, you can get in touch with your bookkeeper from Bench’s platform or their app and they generally reply in a day.

QuickBooks Support

We refine our procedures with these regulations and regularly check with industry professionals to offer the utmost security. As an addition, you get access to lower credit card transaction fees, pre-authorized debit transaction fees, and many other benefits. We weighted each category equally to calculate our star ratings, and we also considered our accounting expert’s opinion and advice when ranking our top brands.

Pay your team

Typically, CPAs and accounting firms consider outsourcing bookkeeping at several key junctures. So if you’re in need of a bookkeeper that’s dedicated to helping you and your business succeed, schedule a free bookkeeping consultation and learn if QuickBooks Live Bookkeeping is right for your business. Our team of skilled professionals is equipped to handle diverse bookkeeping needs, ensuring that you receive a service that’s not just cost-effective but also reliable and of the highest quality.

It also saves you the time that you would have wasted in correcting errors made by accountants. There are three plans that you can choose from but the Flex plan is a good choice for small businesses who already have a bank discounts account and are looking for an outsourced accounting service. If you encounter complexities in financial transactions that require specialized expertise, outsourcing offers access to skilled professionals with the requisite knowledge. You can also invest the time saved in high-margin revenue generation activities and focus your attention on advisory services. Outsource bookkeeping services to QX and work with offshore bookkeepers who act as a seamless extension of your in-house team. They are meticulous and work out of a highly secure environment, and with the latest bookkeeping tools to ensure they deliver high-quality work quickly.

Many accountants offer bookkeeping as part of their accounting services or are willing to get you caught up before tax season. But the catch is that a CPA will generally charge more per hour than a bookkeeper would. They’ll typically charge their hourly rate, which is higher than a bookkeeper’s, because of the hard work in getting accredited. For example, when you sign up with Bench, you’re paired with a team of professional bookkeepers who gather your data and turn it into tax-ready financial statements each month. Then, our platform lets you track your finances, download financial statements for your accountant, and message your bookkeeping team. A freelance bookkeeper or a firm will operate outside of your business—they’re not an employee.

Management Accounts

- At Outbooks, we value privacy and secrecy of information as highly as you do.

- With most outsourced accounting service providers, you will be assigned a dedicated bookkeeper.

- SmartBooks also helps businesses with payroll management and benefits management by integrating with other service providers like Gusto and ADP.

- We give you your time back, so you can build your business knowing your books will be accurate and you can use financial data to help you grow.

- For example, when you sign up with Bench, you’re paired with a team of professional bookkeepers who gather your data and turn it into tax-ready financial statements each month.

We’ll reconcile and categorize your transactions, give you monthly financial statements, and put you in direct touch with your new bookkeeper through our messaging app. Virtual accounting services on the other hand rely on accountants to keep their business going operation and maintenance expenses definition therefore they make sure they hire the best and most qualified accountants. This ensures that all your accounts are maintained perfectly with zero errors.

Not only does this ensure that your payroll gets recorded correctly, but also makes sure your disbursements happen on time and you follow all compliances like workers compensation and others. For example, SmartBooks lets you know that each of their accountants has more than ten years of experience. There are no standard plans mentioned on their site but they do have an option to request a quote where depending on your requirements, and the industry your business belongs to you can get a custom plan. Irrespective of the size of your business, you can utilize these services that can be customized the balance sheet depending on the needs of your business. If you are a small business with under a hundred transactions, the Basic plan might be ideal.

Catégorie: Bookkeeping | Tags:

CCC Klub, buty, moda i trendy Aplikacje w Google Play

Nie ma co się temu dziwić – skoro przekonaliśmy się już do robienia zakupów przez smartfona, mało sensowne byłoby rezygnowanie z aplikacji, która gwarantuje Cofnij się do poważnych błędów na południowo-wschodnich operacjach kolejowych dodatkowe korzyści. Teraz możesz dodać swoją kartę Klubu CCC do aplikacji mobilnej i mieć ją już zawsze przy sobie. Jeśli jeszcze jej nie masz, to nie problem. Aplikacja umożliwia również rejestrację do Klubu. Najnowsze promocje będą bliżej Ciebie.

KLUB CCC TERAZ W APLIKACJI MOBILNEJ

Wcześniejszy dostęp do akcji promocyjnych, kodów rabatowych i wyprzedaży to jednak nie wszystko. Nieraz uruchamiane są dodatkowe atrakcje. Mamy tu na myśli zniżki typu 5% lub 10% na pierwsze zakupy w aplikacji. Taki rabat powitalny jest naprawdę godny uwagi, prawda?

Po podaniu daty urodzenia staniesz się jego członkiem, wraz ze wszystkimi przywilejami. Wybierz Google Pay jako metodę płatności i przejdź do podsumowania,2. W wyświetlonym okienku wybierz swoje konto Google,3. Wybierz kartę, którą dokonasz płatność (lub dodaj nową),4. Teraz Klub CCC działa w aplikacji mobilnej, co oznacza, że wszystkie promocje dla Klubowiczów będą aktywowane właśnie podczas zakupów w smartfonie.

- Teraz możesz dodać swoją kartę Klubu CCC do aplikacji mobilnej i mieć ją już zawsze przy sobie.

- Aby dowiedzieć się więcej, zapoznaj się z zasadami ochrony prywatności dewelopera.

- Warto wspomnieć, że aplikacja CCC umożliwia także dodawanie karty Klubu CCC, co sprawia, że podczas zakupów nie musimy mieć jej przy sobie (wystarczy uruchomić program na smartfonie lub tablecie).

- Zostaniesz przekierowany na stronę operatora płatności z domyślnie zaznaczonym polem Apple Pay,4.

Warto wspomnieć, że aplikacja CCC umożliwia także dodawanie karty Klubu CCC, co sprawia, że podczas zakupów nie musimy mieć jej przy sobie (wystarczy uruchomić program na smartfonie lub tablecie). Twoje zakupy są bezpieczne – Google Pay chroni dane Twojej karty dzięki kilku warstwom zabezpieczeń. W przypadku, gdy płatność nie powiodła się, spróbuj raz jeszcze wejść na link płatności, który znajdziesz w informacji mailowej potwierdzającej złożenie zamówienia. W razie dalszych problemów, skontaktuj się z BOK. Konsultanci wygenerują nowy link do płatności i wyślą Ci go na adres mailowy podany w Zamówieniu.

Wybierz płatność Kartą Podarunkową i wpisz jej numer oraz kod pin,2. Przejdź do podsumowania zamówienia,3. Za zamówienie możesz zapłacić bezpośrednio przy odbiorze paczki od kuriera. Dzięki aplikacji mobilnej z łatwością wyszukasz najbliższy sklep stacjonarny oraz sprawdzisz dostępność produktów.

i dodawaj produkty

A jeśli to wszystko nie przekonuje Cię do pobrania aplikacji CCC na telefon, pamiętaj, że znajdziesz w niej również listę sklepów stacjonarnych, a nawet sprawdzisz dostępność produktów, które wpadły Ci w oko. Za pomocą tego narzędzia możemy zamawiać produkty w internecie, a następnie odbierać je osobiście w jednym z wybranych Citi dołącza do American Financial Exchange jako animator rynku swapów procentowych AMERIBOR sklepów. Podczas transakcji Apple Pay wykorzystuje jedynie numer przypisany konkretnemu urządzeniu i unikalny kod transakcji, numer Twojej karty nie jest przechowywany. Wygoda, dodatkowe rabaty i coraz silniejsze przyzwyczajenie do załatwiania codziennych spraw z pomocą smartfona powodują, że zakupy online znacznie chętniej niż kiedyś robimy poprzez aplikacje mobilne. Przekłada się to na zainteresowanie aplikacjami sklepów internetowych, szczególnie tak znanych, jak CCC.

W aplikacji CCC obejrzysz najnowsze kolekcje, a także produkty z poprzedniego sezonu w wyjątkowych cenach. Jeśli to Twój pierwszy raz z Google Pay, Zobacz więcej informacji o tej usłudze, m.in. Jak dodać kartę i jak odbywa się jej weryfikacja. Jeśli płacisz gotówką, to przed spotkaniem z kurierem przygotuj odliczoną kwotę płatności – kurier nie jest zobowiązany do wydawania reszty. W najnowszej wersji aplikacji wprowadziliśmy zmiany optymalizacyjne i poprawiliśmy znane błędy.

I want to return Items online

Przed dokonaniem płatności upewnij się, że masz dodaną kartę w aplikacji Wallet na urządzeniu,2. Wybierz Apple Pay jako metodę płatności i przejdź do podsumowania,3. Zostaniesz przekierowany na stronę operatora płatności z domyślnie zaznaczonym polem Apple Pay,4. Potwierdź transakcję za pomocą Face ID lub Touch ID. Przez długi czas informacje o promocjach dla klubowiczów miały na stronie sklepu swoją odrębną kategorię.

CCC shoes & bags – online shop

Dla Uczestników Klubu, którzy złożyli zamówienie i wybrali metodę dostawy „Odbiór w sklepie” mamy zniżkę 20% na zakupy w sklepie CCC. CCC to darmowa, oficjalna aplikacja znanej sieci sklepów obuwniczych. Google Pay to szybki i prosty sposób płatności oferowany przez Google, dostępny na wszystkich urządzeniach z Androidem.

Dziś połączone są one z zakładką poświęconą aplikacji mobilnej CCC, która stanowi doskonałe źródło informacji o dodatkowych rabatach. Korzystając z podstrony „Klub i aplikacja mobilna”, otrzymasz instrukcję korzystania z promocji CCC dla Klubowiczów właśnie przez aplikację. Okazuje Jim Simons: kierownik najczęściej udanego funduszu hedgingowego w historii opowiada o swojej karierze się, że aby założyć kartę CCC online, możesz dołączyć do Klubu, wykonując kilka kliknięć w swoim telefonie.

BLIK to polski system płatności mobilnych, który umożliwia użytkownikom smartfonów m.in. Dokonywanie płatności w sklepach internetowych. Płatność kartą płatniczą w sklepie internetowym odbywa się tą samą kartą, co w zwykłym sklepie.

Catégorie: Forex Trading | Tags:

Closing Entries Definition, Examples, and Recording

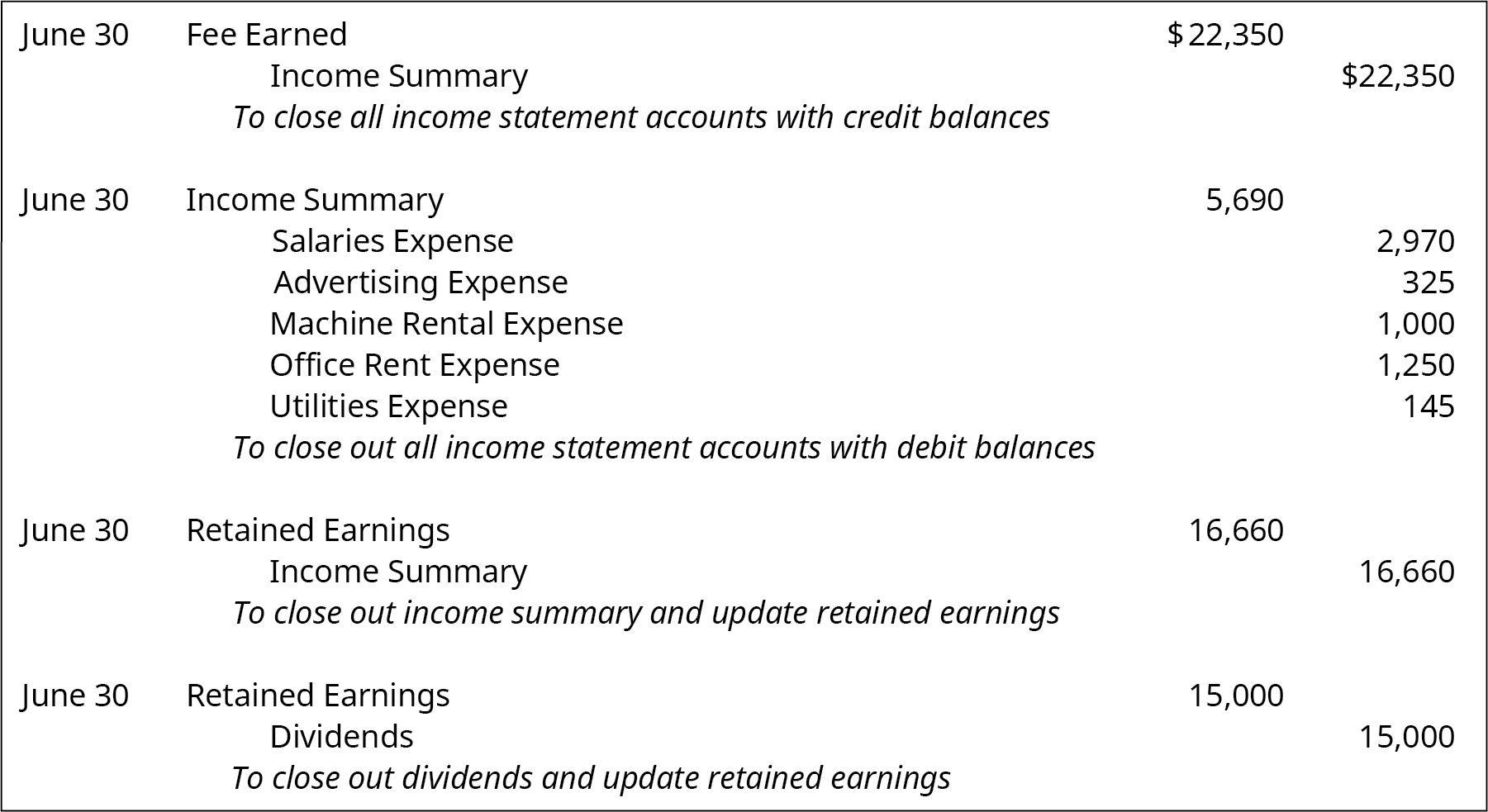

For our purposes, assume that we are closing the books at the end of each month unless otherwise noted. We at Deskera offer the best accounting software for small businesses today. Our program is specifically developed for you to easily set up your closing process and initiate book closing within seconds – no prior technical knowledge necessary. Now, the income summary account has a zero balance, whereas net income for the year ended appears as an increase (or credit) of $14,750.

Step 2: Close all expense accounts to Income Summary

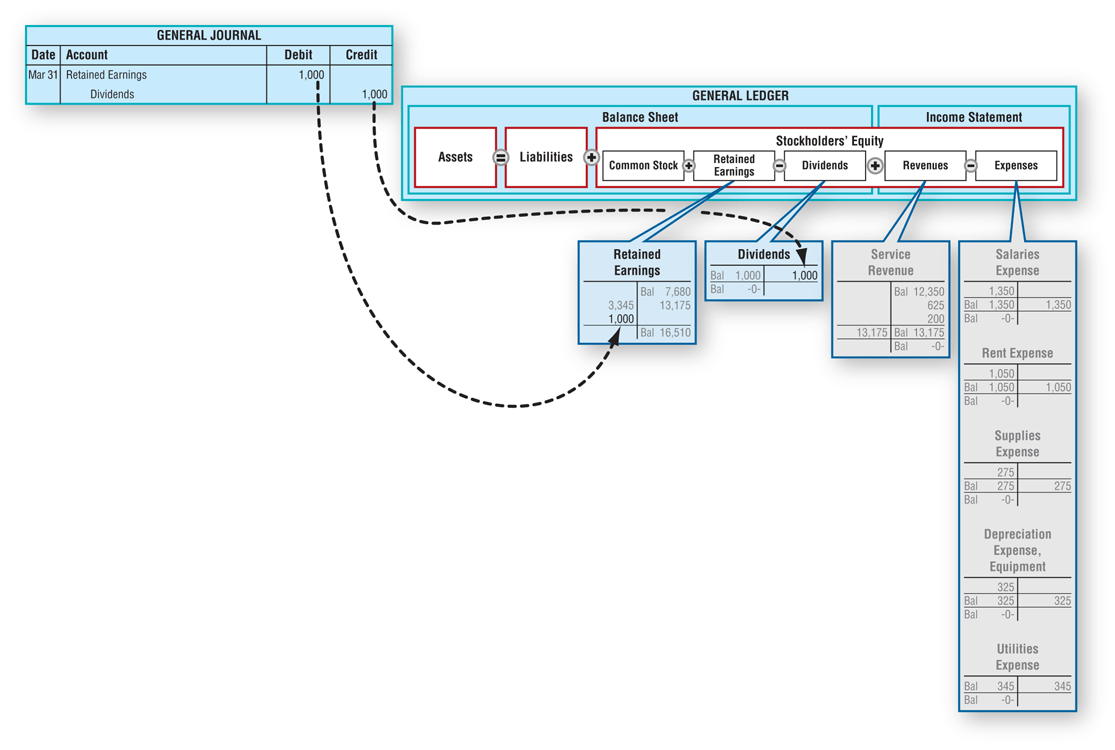

These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings. To further clarify this concept, balances are closed to assureall revenues and expenses are recorded in the proper period andthen start over the following period. In summary, permanent accounts hold balances that persist from one period to another. In contrast, temporary accounts capture transactions and activities for a specific period and require resetting to zero with closing entries. Instead, the basic closing step is to access an option in the software to close the reporting period.

Reviewed by Subject Matter Experts

These accounts will not be set back to zero at the beginning of the next period; they will keep their balances. The accounts that need to start with a clean or $0 balance going into the next accounting period are revenue, income, and any dividends from January 2019. To determine the income (profit or loss) from the month of January, the store needs to close the income statement information from January 2019. The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data.

- Our program is specifically developed for you to easily set up your closing process and initiate book closing within seconds – no prior technical knowledge necessary.

- All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary.

- In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts.

- Opening entries include revenue, expense, Depreciation etc., while closing entries include closing balance of revenue, liability, Depreciation etc.

Drawings Accounts and Closing Journals

Income summary is a holding account used to aggregate all income accounts except for dividend expenses. It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process. The net income (NI) is moved into retained earnings what is an accrued expense square business glossary on the balance sheet as part of the closing entry process. The assumption is that all income from the company in one year is held for future use. One such expense that’s determined at the end of the year is dividends. The last closing entry reduces the amount retained by the amount paid out to investors.

All expenses can be closed out by crediting the expense accounts and debiting the income summary. After this closing entry has been posted, each of these revenue accounts has a zero balance, whereas the Income Summary has a credit balance of $7,400. Permanent accounts track activities that extend beyond the current accounting period. They’re housed on the balance sheet, a section of financial statements that gives investors an indication of a company’s value including its assets and liabilities. Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company.

Part 2: Your Current Nest Egg

The balance in Income Summary is the same figure as what is reported on Printing Plus’s Income Statement. Both closing and opening entries record transactions, but there is a slight variation in their purpose. If dividends were not declared, closing entries would cease atthis point.

As the drawings account is a contra equity account and not an expense account, it is closed to the capital account and not the income summary or retained earnings account. The purpose of the income summary is to show the net income (revenue less expenses) of the business in more detail before it becomes part of the retained earnings account balance. After the closing journal entry, the balance on the dividend account is zero, and the retained earnings account has been reduced by 200. Why was income summary not used in the dividends closing entry?

All of Paul’s revenue or income accounts are debited and credited to the income summary account. This resets the income accounts to zero and prepares them for the next year. In essence, we are updating the capital balance and resetting all temporary account balances. When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings. Note that by doing this, it is already deducted from Retained Earnings (a capital account), hence will not require a closing entry.

Catégorie: Bookkeeping | Tags:

Florida Income Tax Rates for 2025

Florida’s lack of state income tax is a significant factor for individuals and businesses considering relocation, as it can lead to substantial savings compared to states with higher income tax rates. The federal income tax is a tax that the United States government levies on the annual earnings of individuals, corporations, trusts, and other legal entities. This tax is progressive, which means the tax rate you pay — the percentage of each additional dollar that goes to the government — increases as your income increases. For individuals, the income tax rates on ordinary income (as distinguished from capital gains) start at 10% and increase up to 37% as your income tax bracket increases. Understanding and calculating your tax burden in Florida is crucial for effective financial planning.

Federal Married (separate) Filer Tax Tables

Read more here and check out our Guided Planner tool, where we’ll point you toward the strategies that might apply to you. The base sales tax rate is 6%, with some counties adding their own surtaxes, which range from 0.5% to 1.5%. The Florida sales tax is 6% for most products, and the proceeds make it the single largest source of tax revenue for the state government. If you earn income in Florida, you know you’ll lose something to taxes. It’s important to understand your state’s income tax and how it will impact your financial future, not least because that knowledge will empower you to take action to reduce your tax bill today.

Combined Marginal Income Tax Rates & Brackets: Florida

- You can choose another state to calculate both state and federal income tax here.

- Urban areas with higher housing prices, like Miami-Dade County, tend to levy higher property taxes.

- TurboTax makes it easy to file your federal taxes and understand how Florida’s unique tax setup impacts you.

- Also, tax bills in Florida have gotten so high that more than 66% of Floridian voters passed a ballot measure aimed at increasing their property tax break.

- Our partners cannot pay us to guarantee favorable reviews of their products or services.

Get $30 off a tax consultation with a licensed CPA or florida income tax EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have. Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners. Florida either does not have income tax or taxes dividend and interest income only. The Simplified Tables do not include the Social Security and Medicare taxes, which are collectively referred to as the FICA taxes.

- Homeowners must apply to receive an additional homestead exemption.

- Instead, all income tax calculations for the year 2024 are based solely on the Federal Income Tax system.

- The federal income tax is a tax that the United States government levies on the annual earnings of individuals, corporations, trusts, and other legal entities.

- Property taxes are a vital component of Florida’s tax system, impacting homeowners significantly.

- For example, if you’re a California resident who worked in Florida in 2024, you must report your Florida earnings on your California (and federal) return.

State Corporate Income Tax Rates and Brackets, 2025

The TPP return is due to the local property appraiser by April 1 and reports all property owned on January 1. Taxpayers https://www.bookstime.com/ requiring a TPP return will be eligible for a $25,000 exemption if the return is filed by the deadline. Once you have your Florida corporate income, you can subtract a $50,000 exemption to arrive at your taxable total. The amount of tax you owe each year is calculated based on your gross income, which includes wages, interest, dividends, and other earnings.

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more. income summary The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

What is the Income Tax?

At Taxfyle, we connect individuals and small businesses with licensed, experienced CPAs or EAs in the US. We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will handle filing taxes for you. Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey. Katelyn has more than 6 years of experience working in tax and finance. She believes knowledge is the key to success and enjoys providing content that educates and informs. Because Florida does not have a personal income tax, military pensions and active-duty pay are not taxed.

Tax Year 2023 Florida Income Tax Brackets

Florida has a 0.71 percent effective property tax rate on owner-occupied housing value. Property tax in Florida is a county tax that’s based on the assessed value of your home. Homes are appraised for market value as of Jan. 1 of each year by county appraisers.

Catégorie: Bookkeeping | Tags:

Service commercial : 01 80 88 43 02

Service commercial : 01 80 88 43 02